An Integrated Framework For Service Quality, Customer Satisfaction And Behavioral Responses In Indian Banking Industry— A Comparison Of Public And Private Sector Banks

This study attempts to investigate the relationship between service quality, overall customer satisfaction and behavioral intentions across public and private banks in India. The findings indicated that service quality is a significant determinant of customer satisfaction in Indian banking industry irrespective of public and private sector banks. However, different dimensions of service quality were found to be statistically significant across public and private banks. Customer satisfaction was found to be strongly associated with propensity to recommend. The study will help banks to redefine their corporate image to one that is customer-focused and driven by service quality.

INTRODUCTION

The Indian banking has seen momentous changes in the post independence era. It has witnessed a remarkable shift in its operating environment during the last decade. Various reform measures, both qualitative and quantitative, were introduced with an objective to revitalise Indian banking sector and to meet the future challenges. Every aspect of the functioning of the Indian banking industry, be it a customer service, resource mobilisation, credit management, asset-liability management, investments, human resource development, and forex management are under going dramatic changes with the reforms gathering the momentum and speed. Several innovative IT-based services such as Automated Teller Machines (ATMs), electronic fund transfer (EFT), anywhere-anytime banking, smart cards, internet banking etc. are no longer alien concepts to Indian banking customers (Rawani and Gupta, 2000). The market has changed drastically and has become largely customer centric. From sellers market the banks have been forced to operate in the buyer’s market. The change has made the customer a king. The customer, in future, will continue to demand new and better products, will switch to new providers Monica Bedi Journal of quickly, will find information easily, and may even do more and more of ‘legwork’ personally. All of these factors mean more buying power for the consumer. The key to success in the changed environment will be one’s ability to reach the client at his doorsteps, and providing products and services in a customised manner. Thus, with these changes customers’ expectations and perceptions of service quality are bound to change. Today’s customer is not going to settle on anything less than his/her expectations. To compete, successfully, with each other, banks are using different marketing strategies to live up to the customers expectations and stay ahead in the league. Banks have focused to develop strategies to differentiate themselves from their competitors and providing their customers with high quality banking services and highly technology innovative products. It is within this rapidly changing environment that service quality and customer satisfaction is compelling the attention of all banking institutions (Angur et al.,1991). Banking institutions are acknowledging that unless customer needs are taken into account in designing and delivering services, technical superiority will not bring success (Zeithaml and Bitner 1996). New marketing concepts and strategies (Ennew et al., 1993), are paying greater attention to identifying customer needs and expectations (Morgan, 1989), and offering high service quality to customers (Thwaites and Vere, 1995; Lewis, 1993). As argued in literature (Lewis et al., 1994, Gronroos, 1990; Zeithaml, et al., 1990; Brown and Swartz, 1989), it is probably the effective measurement, management and improvement of service quality which will enable banking institutions to achieve a differential advantage over their competitors (Lewis, 1991). Service quality, therefore, has become a critical prerequisite for satisfying and retaining valued customers in banks (Taylor and Baker, 1994; Cronin and Taylor, 1992). The interest is largely driven by the realization that high service quality results in customer satisfaction and loyalty with the product or service, greater willingness to recommend someone else, reduction in complaints and improved customer retention (Danaher, 1997; Levesque and McDougall, 1996; Magi and Julander, 1996; Zeithaml et al., 1996). Further, a satisfied customer is likely to be a loyal customer who will give repeating business to the bank (Heskett et al., 1997). More importantly, the cost of retaining existing customers by improving product and services is perceived to be significantly lower than the cost of winning new customers. Because of the importance of the service quality and customer satisfaction as a route to competitive advantage and corporate profitability in banking, it has become difficult to identify a single bank which has not initiated some kind of service quality improvement drive (Newmann, 2001; Soteriou and Stavrinides, 2000). Also, a clear and detailed understanding of the demands of the various market segments is essential to successfully target new markets and to maintain a repeat customer base (Yoon and Yuksel, 2003).

Undoubtedly, owing to the belief that delivery of high service quality is a must for attaining customer satisfaction and a number of other desirable behavioural outcomes, recent years have witnessed a flurry of research exploring interrelationships between service quality and customer satisfaction. This study expands the research stream in Indian banking sector. Specifically, the study used a survey of Indian bank customers to develop theoretically and empirically the understanding of the relationship between Service Quality, Customer Satisfaction and behavioural responses. This study seeks to evaluate empirically the degree of effect on customer satisfaction of various service quality dimensions as perceived by customers. Deriving factors influencing customer satisfaction, it attempts to clarify the relationship between customer satisfaction and customer behavioral intention in Indian public and private sector banks.

Indian banking environment, where Indian bankers consider delivery of excellent service quality to customers a key to success and survival, the findings from the study can provide them with valuable insights in ways of enhancing service quality so as to induce greater customer satisfaction and positive behavioural outcomes.

OBJECTIVES

1. To study customer perception in terms of the tangibles, empathy, assurance and reliability dimensions of service quality across public and private sector banks.

2. To study the relationship between Service Quality, Customer Satisfaction and Behavioral responses in Indian banking Industry across Public and Private Sector Banks.

METHODOLOGY

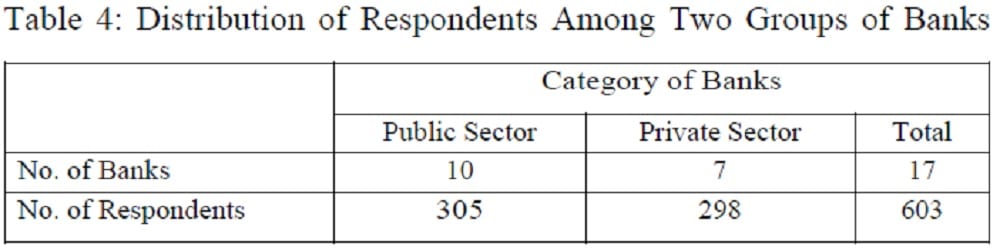

To accomplish the aforementioned research objectives, the data for this study was collected through self-administered questionnaire. The questionnaire used in the study was initially developed through interviews with bank managers, public and private bank customers and public and private bank staff in the study areas. These preliminary interviews helped to clarify issues and concepts to be covered, thus helping to process the survey into an instrument that was applicable, relevant and comprehensible by respondents. The survey was designed to obtain information about the determinants of customers’ bank selection decisions. A total of 700 customers from 17 banks have been approached, from whom 603 correctly completed questionnaires have been obtained, yielding rate of about 86.14%. Table 4 shows the number of banks in each group and the corresponding number of respondents (customers) who have participated in the study. The high response rate is due to the personal-contact approach followed by periodic follow ups over telephone and personal visits.

The survey was undertaken to identify the importance of factors in choosing a commercial bank and the perceived usefulness of bank services among public and private bank customers. It is clearly very difficult to seek a representation of bank customers in a country as regionally and geographically diverse as the India with such a small sample. It was cross-checked to make it sure that the sample taken reflected the demographic and socioeconomic (gender, age, education, occupation, income) make-up of the public and private bank customers in the region. The questionnaire contained three major groups of questions:

(1) The importance of attributes considered in choosing a commercial bank;

(2) Overall customer satisfaction with bank services ; and

(3) A number of control variables such as gender, age, education, occupation, and income.

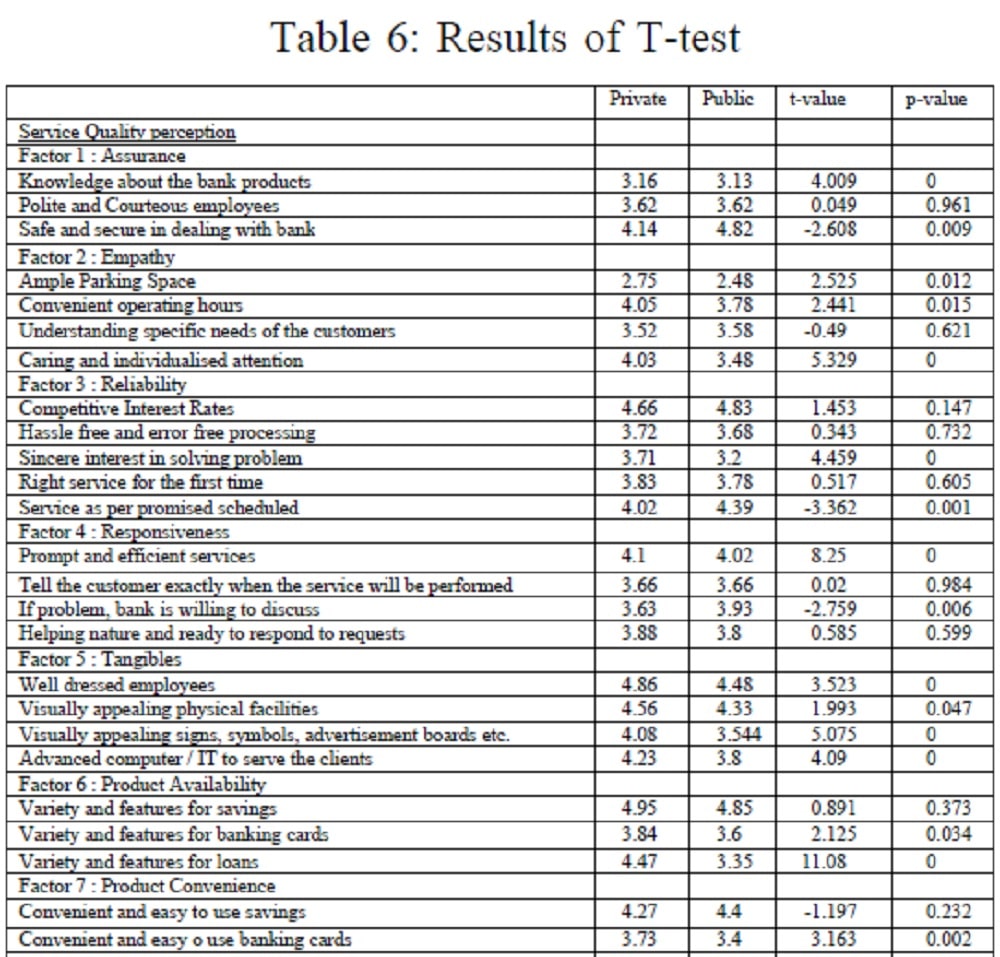

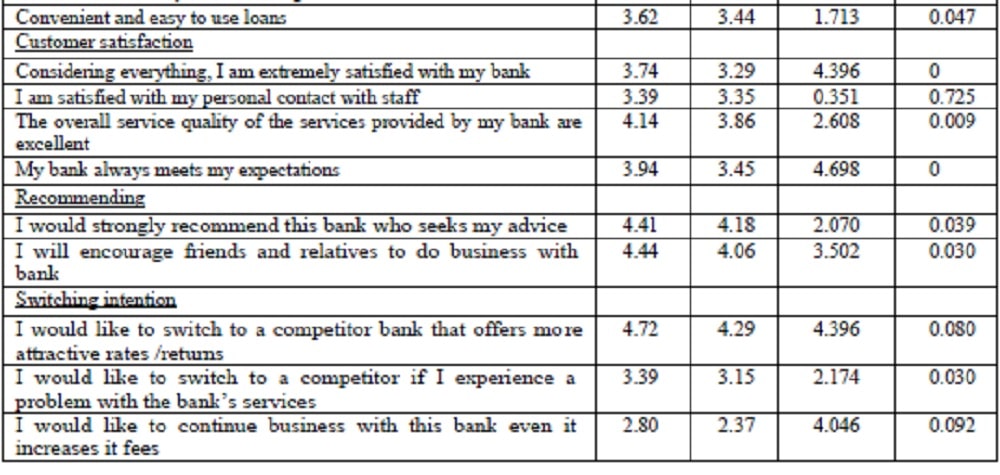

All items were measured on the five-point Likert scale from 1 (strongly disagree) to 5 (strongly agree). Satisfaction was operationalised by four item measures. T-test was, then, carried out in order to test the hypothesis that service quality perception, customer satisfaction and behavioral intentions differ across private sector banks and public sector banks (See Table 6). Finally, regression analysis and correlation analysis were carried out to clarify the relationship between service quality and customer satisfaction and behavioral intentions (See Table 7,8,9,10).

DATA ANALYSIS AND RESEARCH RESULTS

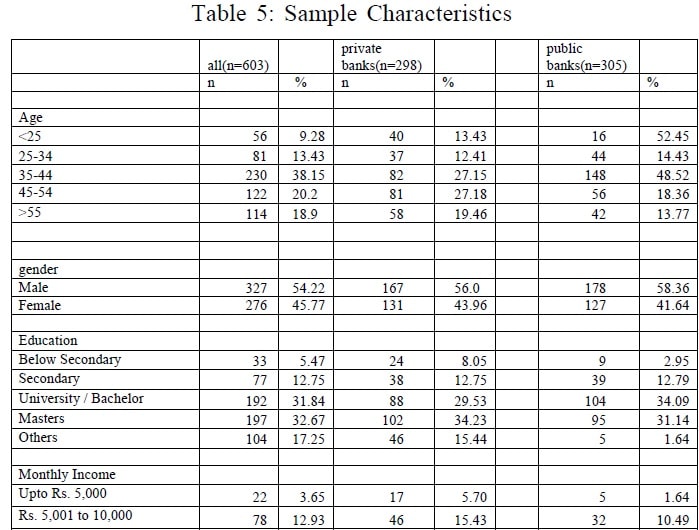

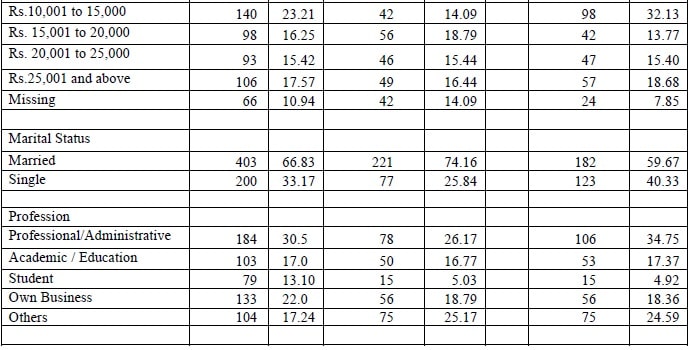

This section deals with the results analysed to study whether the average perception of service quality, satisfaction and behavioural responses vary across public and private sector banks. The data collected was analysed according to customer use of banks in the private sector (Group 1) and the public sector (Group 2). Table 5 shows the sample distribution between the two banking sectors as it relates to client age, gender, education, monthly income, marital status, occupation and the duration of their relationship with the banks. Close examination of the profile shows that while local and national bank customer segments were similar in terms of their level of education, there were statistically significant differences in terms of other demographic characteristics. It can be seen in Table 5, the sample consists of almost equal males (54.22 %) and females (45.77%). Majority of the respondents (77.25%) are more than 35 years of age. About 39.79% of the sample earned a salary of less than 15,000 a month. Most respondents have achieved at least university degree/Bachelor degree (31.84%). There are more respondents who were married (66.83%) than singles (33.17%). Around 30.5% of the respondents hold positions as professional/administrative and academic/education. As a whole, the sample is skewed towards the more educated segment of the population. According to the t-test analysis, these two groups of respondents had no significant differences across all of the key variables. Accordingly, it seems that non-response bias did not appear to be a significant problem.

Private and Public Sector Banks: A Comparison of Customer Perception of Service Quality, Degree of Satisfaction and Behavioural responses

T-test was used to analyse the service quality perception across private sector banks and public sector banks. Table 6 shows the results of the analysis. The results indicate that pubic and private sector bank customers have different perception of receiving a quality service. It is worth noting that in seventeen out of twenty six factors, clients of private banks perceived receiving a high level of quality then did those of the public banks. When applying t-test on the differences between the mean scores of two groups, it is noticed that in thirteen out of twenty six factors, the differences were statistically significant at the 95% level. The level of significance, thus, was 0.05 or lower for thirteen out of the twenty-six items. The table also shows the overall customer satisfaction with the bank and its services. It can be seen that out of six items, the private bank customer seemed to be more satisfied than public bank customer in five items. Table 6 shows that public and private sector bank customers have different opinion towards propensity to recommend. In all the items, public bank mean score which higher with respect to private sector bank customers. In case of the future switching intentions for both public and private bank customers, mean for private sector customers are higher than public sector bank customers.

The statistical significant difference in service quality perception existed in the following items that related to:

- Knowledge about the bank products (p=0.000)

- Ample parking space (p=0.012)

- Convenient operating hours (p=0.015)

- Caring and individualised attention (p=0.000)

- Sincere interest in solving problem (p=0.000)

- Prompt and efficient services (p=0.000)

- Well-dressed employees (p=0.000)

- Visually appealing physical facilities (p=0.047)

- Visually appealing signs, symbols, advertisements boards etc. (p=0.000)

- Variety and features for banking cards (p=0.034)

- Variety and features for loans (p=0.002)

- Convenient and easy to use banking cards (p=0.047)

The statistical difference in customer satisfaction perception was found in the items that relate to: - Overall satisfaction with bank services (p=0.000)

- Overall service quality is satisfactory (p=0.009)

- Overall product quality is satisfactory (p=0.005)

- Bank always meets my expectation (p=0.000)

The statistical significant difference in behavioral intentions were found in item that relate to:

- Recommending the bank the someone who seeks my advise (p=0.039)

- Encouraging friends and relatives to do business with the bank (p=0.030)

- Switching if experienced a problem (p=0.030)

Statistically significant differences between public bank and private bank customers were not recorded in the remaining of the questionnaire items related to service quality, customer satisfaction and behavioral intentions ( i.e. propensity to recommend and switching intention).

Correlation and Regression analysis on the relationship among Service Quality, Customer Satisfaction, and Customer Behavior Intentions across Private Sector Banks and Public Sector Banks

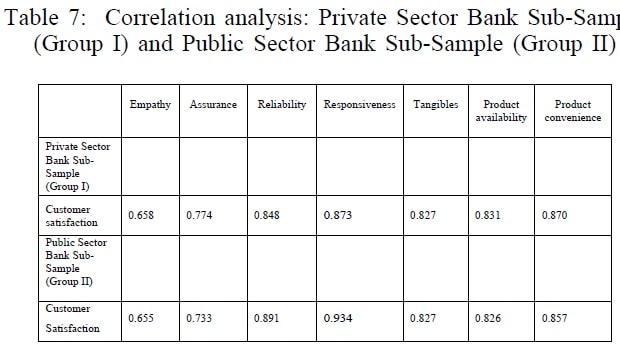

To address the relationship among Service Quality, Customer Satisfaction, and Customer Behavior Intentions ( i.e. propensity to recommend and switching intention) across Private Sector Banks and Public Sector Banks, step wise regression analysis was one on the data collected from the public sector bank sub-sample and private bank sub-sample. The relationship between service quality and customer satisfaction along with behavioural responses (i.e. propensity to recommend and switching intentions) was first investigated using Pearson correlation so as to check the linear relationships between independent and dependent variables. Table 7 shows the Pearson correlation for private sector bank sub-sample (group 1) and public sector bank sub-sample (group II) respectively. Preliminary analysis revealed that their was no violation of the assumption of linearity and homoscedasticity and all associations were found to be significant at 95% level in both sub-samples.

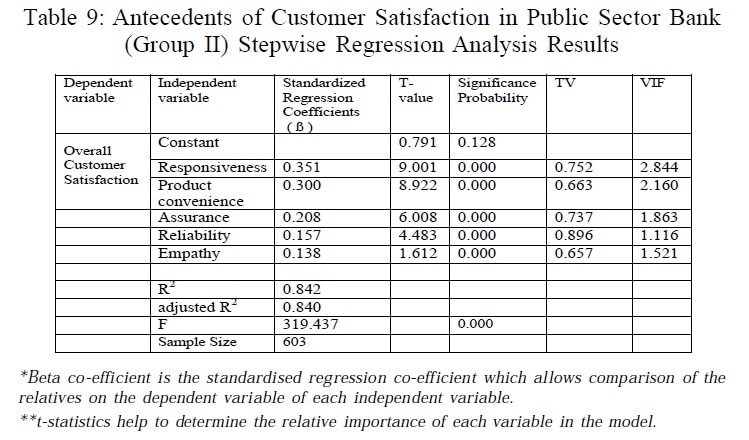

In the second step, to develop beyond this overall picture and to identify which aspects of service quality have a stronger influence on the customer satisfaction step-wise regression was run in case of public sector bank sub-sample and private sector bank sub-sample separately. In each model, seven quality dimensions which consisted of 26 items served as the independent variables and overall customer satisfaction as the dependent variable. Favorable service quality sentiments were expected to result in high level of satisfaction and greater propensity to recommend, but in lower likelihood of switching intentions. Because of the type of the scale, the signs of the coefficients for each of the seven service quality dimensions were expected to be positive with respect to overall customer satisfaction. After conducting regression analysis, multi-linearity diagnostics was conducted in to identify the multi-collinearity problem among independent variables.

** t-statistics help to determine the relative importance of each variable in the model.

A multicollinearity problem is likely to occur when explanatory variables correlate with each other. Consequently, the effect of each variable of the dependent variable becomes difficult to identify. Hence Tolerance Value (TV) and Variance Inflation Factor (VIF) for each explanatory variables were used to measure multicollinearity. Normally a set of explanatory variables is highly correlated if tolerance is low and VIF exceeds ten, thus presenting a multicollinearity problem. The multicollinearity diagnostis statistics were listed in Table 8 & Table 9. It can be seen that tolerance value is towards the higher side and VIF does not exceed the recommending limit.

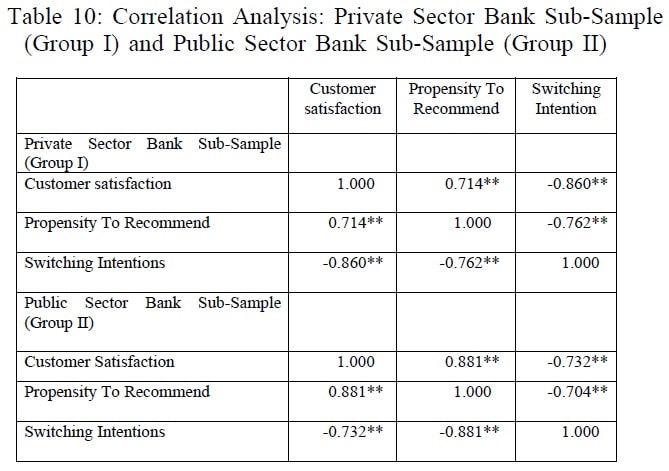

Finally, we carried out correlation analysis to test for a relationship between overall customer satisfaction on the one hand, and Customer Behavior Intentions (i.e. propensity to recommend and switching intention) across Private Sector Banks and Public Sector Banks, and to establish the direction of this relationship (Table 10). Higher overall satisfaction was associated with higher propensity to recommend whereas lower with switching intention.

CONCLUSION AND RECOMMENDATIONS

On an issue about the empirical assessment of the service quality dimensions, the research results confirmed prior research on the issue and indicated that the service quality dimensions are not only industry specific, but also country specific. Indeed there is a differentiation on the factors that constitute the elements of service bundle important to customers depending on industry, culture, and country (Avkiran, 1994).

In this respect, present research revealed the existence of seven-quality dimensions that influence customer satisfaction. With regard to the findings of the study and the model investigated concerning the influences of perceived service quality, the research work provides a comprehensive model which can be used to understand and explain what influences the overall customer satisfaction and quality in the banking sector. The results with respect to customer perception suggest that the service offered by private sector banks has a more favorable influence on actual perceptions of service quality received than in the case with the service from banks in the public sector. The evidence suggests that banks in the public sector do not manage the factors influencing quality perception as well as banks in the private sector, and hence the lower level of perceived service quality received. If service quality as perceived does matter to the customer, other conditions being equal, customer might start drifting from the public to the private sector. The findings of this study suggest that banks should be looking carefully at each one of the dimensions where customers perceive receiving a different service than expected and consider the extend to which they should work on influencing expectations or both. The results also suggested that the dimensions corresponding to the product convenience, responsiveness, reliability, empathy, assurance are significant in determining the overall customer satisfaction and inducing positive behavioural outcomes by reducing negative ones across public sector and private sector banks. Responsiveness has been shown to be an important factor, supporting earlier studies (Avkiran, 1994, Bitner et al., 1990,Berry et al.,1985). This suggests that giving prompt services to the customers; telling the customers exactly when the service will be performed; if there is a problem, the willingness of the bank to discuss with the customer; and readiness of the employees to help and respond to the requests is likely to have an important and positive effect on customer satisfaction.

Several managerial implications emerge from this study. While the findings and guidelines offered in this study hold promise, they should not be viewed as panacea. The ultimate success of any quality program implemented by bank can duly be ganged by creation and retention of satisfied customers. The role of customer-contact personnel in the attainment of these goals is of paramount importance. Therefore, in their efforts to delivery high quality services to their customers so as to attain satisfaction for their customers, banks should not ignore the specific needs of their customer-customer-contact employees such as motivation factors, factors leading to satisfaction (or dissatisfaction) among them, ways and means to enhance employees’ commitment to their jobs, customers and the institutions they work for must be addressed properly.

LIMITATION OF THE STUDY

Every research has its limitation. In designing the study the researcher attempted to be as scientific as possible, the resent study nevertheless has some limitations. Firstly, the limitation concerns the nature of the measures used. The measures included in this research were all based upon the perceptions of the participating customers. Therefore, the potential for data inaccuracies due to item misinterpretation or predisposition to certain responses on the part of the participant does exist. Secondly, responses (with respect to service quality, customer satisfaction and behavioral intentions) have been solicited from the customers of banks in selected cities of northern India. The perception of people may vary from those of the rest of India. The selection of a more representative sample from India would bring more illuminating and comprehensive database forward for better and well informed bank marketing decision making. Also, there were only ten public sector banks and seven private sector banks whose customers participated in this study. As a result, the generalization of the findings of this research should be considered carefully. Moreover,as stated service quality, customer satisfaction and behavioral intentions have been found to change over time, a cross-sectional research design does not offer nearly the same insight into the dynamics of customer relationships with a firm as a longitudinal design. A longitudinal design would afford greater insight.

DIRECTION FOR FUTURE RESEARCH

Although the study expands the knowledge of relationship between service quality and satisfaction, viable prospects for future research remains. Future research efforts could concentrate in building a broader conceptual model of factors that influence perceived service quality. This can be achieved by including other variables, such as the frontline personnel’s conduct during the encounter and the interaction of the user with the technology employed during the provision of the service. Data from longitudinal studies would be particularly useful for capturing the process of dynamics of the relationship between quality and customer satisfaction. It may be worthwhile to study customer satisfaction and service quality over the time, in order to take into account the dynamics in consumer patronage behavior.

REFERENCES

Angur, M.G., Rajan Natarajan and John S. Jahera Jr. (1991) ‘Service Quality In The Banking Industry: An assessment in a developing economy’, International Journal of Bank Marketing, 17:3, 116-123.

Avkiran, N.K. (1994) ‘Developing an Instrument to Measure Customer Service Quality in Branch Banking’, International Journal of Bank Marketing, 12:6, 10-18.

Berry L.L., V.A. Zeithaml, and A. Parasuraman (1985) ‘Quality Counts in Services too’, Business Horizons, May-June, 44-52.

Bitner, M.J. (1990) ‘Evaluating Service Encounters the Effects of Physical Surroundings and Employees Response’, Journal of Marketing, 54:April, 69-82.

Brown, S.W. and T.A. Swartz (1989) ‘A Gap Analysis of Professional Service Quality’, Journal of Marketing, 53:April, 92-98.

Cronin, J.J. and S.A. Taylor (1992) ‘Measuring Service Quality: A Re-Examination and Extension’, Journal of Marketing, 56:July, 55-68.

Danaher, P.J. (1997) ‘Using Conjoint Analysis To Determine The Relative Importance Of Service Attributes Measured In Customer Satisfaction Surveys’, Journal of Retailing, 2, 235-260.

Ennew, C.T., M. Wright and D. Thwaites (1993) ‘Strategic Marketing in Financial Services: retrospect and prospect’, International Journal of Bank Marketing, 11:6, 12-18.

Gronroos, C. (1990) Service Management and Marketing. Lexington Books, Lexington, M.A. Headley, D.E. and S.J. Miller (1993) ‘Measuring Service Quality and its Relationship to Future Consumer Behaviour’, Journal of Health Care Marketing, 4, 32-41.

Heskett, J.L., W.E. Sasser, and L.A. Schlesinger (1997) The Service Profit Chain, New York, The Free Press.

Lewis, B.R., J. Orledge, and V.W. Mitchell (1994) ‘Service Quality: Students’ Assessment of Banks and Building Societies’, International Journal of Bank Marketing, 12:4, 3-12.

Lewis, B.R. (1993) ‘Service Quality: Recent developments in financial services’, International Journal of Bank Marketing, 11:6, 19-25.

Lewis, B.R. (1991) ‘Service Quality: An international comparison of bank customers’ Expectations and Perceptions’, Journal of Marketing Management, 7, 47-62.

Lewis, B.R. (1989) ‘Quality in the Service Sector: A Review’, International Journal of Bank Marketing, 7, 4-12.

Levesque, T., and G.H.G. McDougall (1996) ‘Determinants of Customer Satisfaction in Retail Banking’, International Journal of Bank Marketing, 14:7, 12-20.

Magi, A. and C.R. Julander (1996) ‘Perceived Service Quality and Customs Satisfaction in a Store Performance Framework’, Journal of Retailing and Consumer Services, 1, 33-41.

Morgan, N.A. (1989) ‘Developing Information Strategies in the Financial Services Sector’, Marketing Intelligence and Planning, 7:7/8, 24-28.

Newmann, K. (2001) ‘Integrating SERVQUAL: A critical assessment of service quality measurement in a high street retail’, International Journal of Bank Marketing, 19:3, 126-139.

Soteriou, A.C. and Y. Stavrinides (2000) ‘An Internal Customer Service Quality Data Envelopment Analysis Model For Bank Branches’, International Journal of Bank Marketing,

Taylor, S. and T. Baker (1994) ‘An Assessment of the Relationship between Service Quality and Customer Satisfaction in the Formation of Consumer’s Purchase Intentions’, Journal of Retailing, 70:2, 163-178.

Thwaites, D. and I. Vere (1995) ‘Bank Selection Criteria-Student Perspective’, Journal of Marketing Management, 11, 133-149.

Yoon, T.H. and Yuksel, E. (2003) ‘An examination of the SERVQUAL dimensions using the Guttman scaling procedure’, Journal of Hospitality and Tourism Research, 27:1, 3-23.

Zeithaml, V.A., and J.M. Bitner (1996) Services Marketing, New York, Mc Graw-Hill.

Zeithaml, V.A., A. Parasuraman, and L.L. Berry (1990) Delivering Quality Service – Balancing Customer Perceptions and Expectations, New York, The Free Press.

Monica Bedi is faculty at University Business School, Panjab University, Chandigarh.