Anomalies In The Indian Stock Markets: The December Effect

This paper investigates the ‘month of the year events’ for the Indian stock market. A Generalised Auto Regressive Conditional Heteroskelasticity (GARCH) framework has been applied to test the existence of calendar month anomalies in the Indian stock market. This model is applied to test if any of the months generate higher mean returns, when compared to other months of the financial year. Data used for this study is from the Bombay Stock Exchange’s Sensex for a period of 15 years. The findings indicate the presence of December effect for the period of study; from 2001 to 2015.The contribution of this paper to existing literature is the suggestion, of an investment strategy which the investors can adopt, in order to gain above average returns from the Indian stock markets.

INTRODUCTION

Efficient market hypothesis as propounded by Fama and Malkiel (1970), states that markets are informational efficient. This means that all past information is fully reflected in asset prices and since all future information is inherently random, future prices cannot be predicted.

Stock market anomalies go against the idea of weak form of market efficiency, as anomalous stock returns imply the predictability of stock prices.

India being an emerging economy, the Indian stock market has been a focus of research lately for many researchers. This paper is an attempt to study the Indian stock market for any existence of month of the year anomalies. Stock market anomalies is an area which generates a lot of interest in researchers, who are investigating the efficiency levels, behavioural patterns and exploring ways of earning above average returns in stock markets.

As the name suggests, an anomaly is a seasonal phenomenon, where stocks traded on the exchange produce anomalous returns during particular, days, weeks or months of the year. Anomalies which have been researched extensively in the Indian stock market are day of the week effect, the weekend effect, month of the year effect, turn of the year events etc.

The objective of this paper is, to investigate the existence of monthly calendar anomalies for the Indian stock market. Research on monthly calendar anomalies highlight effects like the ‘January effect’. The assumption behind seasonality of this kind of a phenomenon for the turn of financial year event like the January effect is, ‘tax-loss selling’ hypothesis which states that, investors tend to sell loss making stocks towards the end of the financial year; in order to offset these losses against profits made in that particular year. And they tend to buy back these securities again in the month of January. The tax loss selling hypothesis was propounded by Branch (1977) in a paper titled ‘A tax loss trading rule’. More evidence on this and January effect was provided by Starks et. al. (2006) in case of municipal bonds closed-ended funds.

Presence of such an effect in India would imply that the month of April produces anomalous returns, as the financial year in India ends in the month of March. The existence of such anomalies will imply that the Indian stock markets are weak form inefficient and also that if such anomalies exist on a sustained basis; they can be exploited as opportunities for earning above normal returns by investors.

LITERATURE REVIEW

The research on seasonality of returns started with Fields (1931), where the author found that the US stock market produced significant negative and positive returns on particular days of the week. Presence of anomalies in a stock market confirms, that the prices do not follow a random walk and hence, the market is not fully efficient. Presence of anomalies is also related to behavioural patterns of the investor community wherein the community as a whole, displays such anomalous behaviour, generating supernormal profits in particular months or days of the year. These anomalies might arise on specific days or months in the year and hence, the name ‘day-of-the-week’ or ‘weekend effect’ and ‘month-of-the-year’ effect have been coined. Day of the week effect has been widely studied for developed markets like the US. However, for emerging economies like India, not much research has taken place for ‘month-of-the-year ‘events, which is the focus area of this paper. The ‘January effect’ which is a ‘turn-of-the-year’ event was first reported by Wachtel (1942) for the US markets. A turn-of-the-year’ event happens when the financial year ends and the new financial year begins. The most cited argument for such an anomaly is the tax-loss-selling hypothesis.

Rozeff and Kinney (1976) have shown, in a study for US markets, that the returns in the first month of the financial year are significantly larger than the other months. Reinganum (1983) in his research on anomalies for small firms found evidence of the January effect, but mentioned that the tax-loss-selling hypothesis cannot be regarded as the sole reason of such an effect. Also, there is evidence on higher returns of stocks around holiday periods. Ariel (1990) showed, that a major part of returns generated in a year were attributable to 8 days prior to a market holiday. Ignatius (1992) found a positive April effect in his study on BSE for the period April 1978 to July 1990 period, and also higher mean returns in the months of June and December; December exhibiting the highest mean returns.

Pandey (2002) in his research on seasonality of Sensex monthly returns mentioned, that returns were statistically significant in the months of March, July and October. This study proved that the stock market returns in India are not entirely random. Kaur (2004) mentioned that the Sensex and Nifty returns do not exhibit any ‘weekend effect’ and also that there is no ‘January effect’ in Indian markets. The research found, that February exhibits highest volatility and highest corresponding returns, therefore, it was suggested that investors should stay away from the markets and should be booking their profits in the month of February itself. Poshakwale (1996) confirms the presence of weekend effect in the Indian stock market, with Fridays generating higher mean returns as compared to other weekdays.

Chakrabarti, G., & Sen, C. (2008) investigate the existence of November effect in the Indian stock market. The findings suggest the existence of a significantly positive November effect which could not be explained by varying volatility of market return. Parikh (2009) confirmed the presence of the ‘December effect’ in the Indian stock market where it is mentioned, that December produced truly anomalous returns. The reasons given for the same are that December and few months before that, are a period of festivities in India and investors have extra cash in their hands.

Patel (2011) considered a period from July 1999 to June 2007 and found mean returns to be higher in the months of November and December for Indian markets.

Kumari and Raj (2006) investigated day-of-the-week effect for Indian market and found anomalous returns on Tuesdays and Mondays for a period from 1979 to 1998. Bhattacharya et. al. (2003) also examine the day of the week effect using a GARCH framework in returns and volatility for Indian stock market. Sah (2009) found Friday effect and June and December months to be giving statistically significant returns for NIFTY. Keong et. al. (2010) in their study on month-of-the-year effects in few Asian countries, conducted for a period of 20 years confirmed, the presence of a positive December effect in most of the Asian stock markets including India. The study also confirmed the presence of January, April, and May effects in few Asian countries. A study by Guidi et. al. (2011) conducted for some Central and Eastern Europe countries revealed, thepresence of higher volatility and returns on Mondays andTuesdays. The study applied OLS and GARCH-M framework for investigating day-ofthe-week effect.

OBJECTIVES

The objective of this study is to investigate the presence of month-of-theyear events in the Indian stock market. The contribution of such a study would be, to enhance our understanding of return and risk characteristics of various months of a year and give suggestion, of an investment strategy for investors in the Indian stock market.

DATA

The study makes use of monthly data of 15 years for the BSE sensitive index, also called the Sensex. BSE Sensex is the index of Bombay Stock Exchange comprising of the top 30 companies listed on the exchange. The performance of these companies and market capitalisation is considered to be the barometer of the performance of stock market as a whole in India. Data for the Sensex has been procured from the official website of the Bombay Stock Exchange. The data points are monthly, ranging from January 2001 to December 2015. THE RESEARCH METHODOLOGY This study uses the GARCH framework to allow for volatility clustering and non-normality of error term. First, the Ordinary Least Sqaure (OLS) framework is used to understand if there is equality in mean returns across all months of the sample period.

The returns for the mentioned period have been calculated using the formula:

Equation (1)

Rt = (log It – Iog It-1) * 100

The monthly closing prices have been used to calculate log returns as

per the above equation.

The following equation tests the month-of-the-year effect using the

OLS method:

Equation (2)

Rt = a1tD1t + a2tD2t + a3tD3t +……+ a12tD12t + ut

where, Rt represents the logarithmic return in month ‘t’; a is the parameter; and D1t to D12t represent the dummy variables for various months of the year. This will assume the value 1 for i-th month into consideration and 0 otherwise. This model is used to characterize monthly mean returns.

The hypotheses for the study are:

H0: There are no seasonal effects in the monthly returns.

H1: There is a presence of seasonality in monthly returns.

If the returns do not show a seasonal pattern then the null hypothesis cannot be rejected. The method of OLS fails to address the issue of time varying volatility found in financial time series data, as in the case of this study. Therefore, a GARCH model has been used. The dummy variables found significant from the OLS model will be used as explanatory variables to be fitted into the GARCH model. The mean and variance equations are given as under:

Equation (3)

Where, is the error term with 0 mean and is the conditional variance, defined by the equation:

Equation (4)

β0 is constant, β, γ, μ and μ* are co-efficients to be estimated. δ’s are monthly dummy variables where k will be the number of month under investigation.

RESULTS

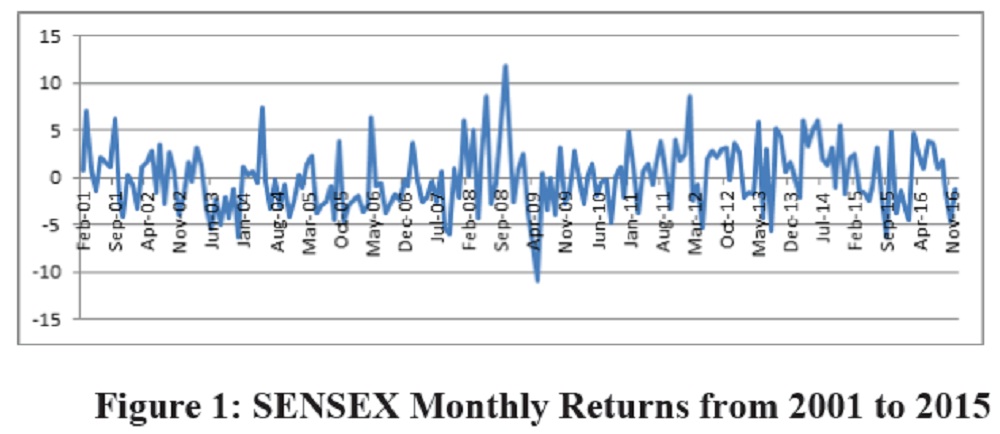

We begin by plotting the Sensex returns over the years starting from 2001 to 2015.

Figure 1 shows the returns calculated as per Equation (1) plotted on a graph.

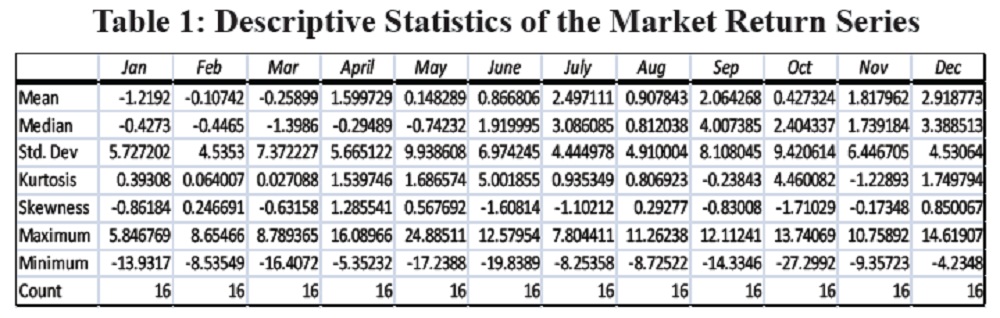

Descriptive statistics for the returns so calculated are presented in Table 1.

Looking at the Table 1, it can be seen that there is wide variation in mean returns for all months. However, for December the mean return is positive and highest as compared to all the other months. The most negative returns are observed for the month of January.

The return series shows high dispersion in the form of higher standard deviation. The months of May and October show the highest dispersion, when compared with other months of the years.

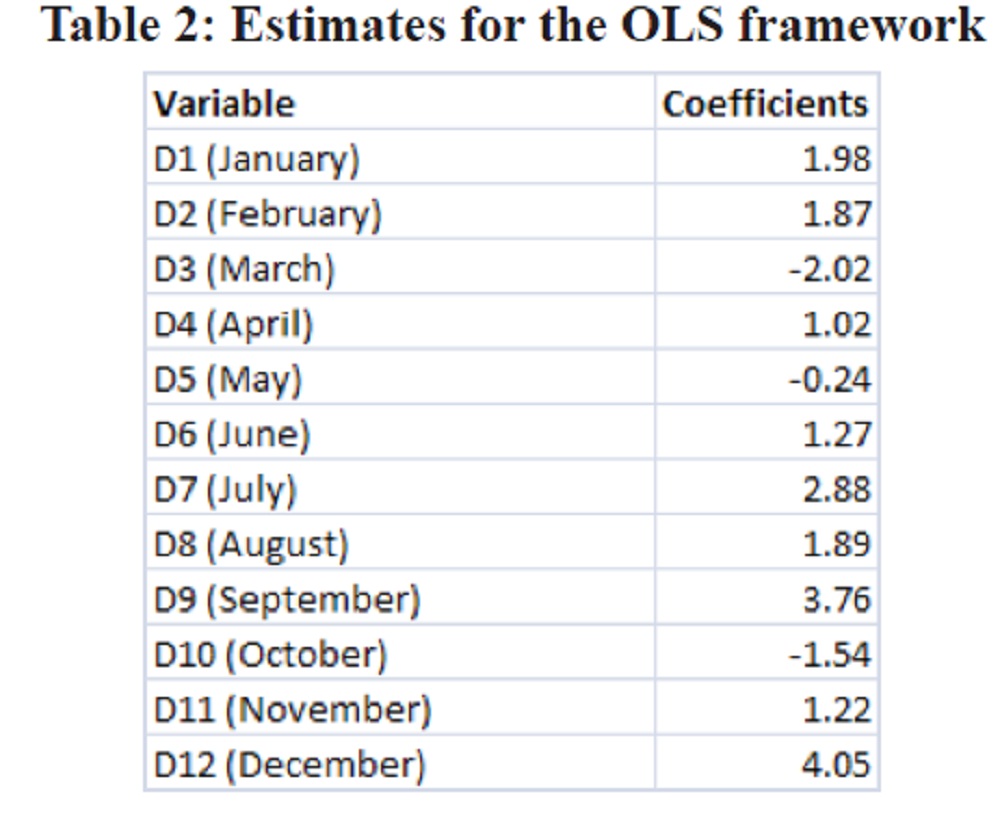

The OLS framework depicted in Table 2 shows that the returns in the month of December are statistically different from zero, at the level of 5% significance. Therefore, as per the OLS framework, it can be concluded that there is the presence of December effect. This brings the study to reject the null hypothesis, that there are no seasonal variations in the Indian stock market and leads to the acceptance of an alternate hypothesis.

However, as the OLS framework is not adequate to capture time varying volatility, we will move to the results of the GARCH (1,1) framework, which have been applied to the month of December in the light of above findings.

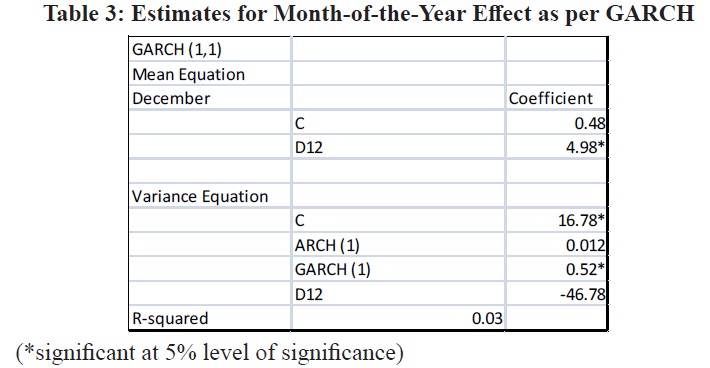

Table 3 represents the GARCH framework for the month of December depicting the results of the mean and variance equations incorporating December as the dummy variable.

It can be seen from the result, that the dummy variable for December is significant in the mean equation. Therefore, it can be concluded that the December effect witnessed in the Indian stock market represents truly anomalous returns and is not a result of time varying volatility alone.

CONCLUSIONS AND RECOMMENDATIONS

The study clearly indicates the presence of the December effect in the Indian stock market. Of the studies which have been done in order to analyze the presence of the month-of-the-year effects, few studies indicate the presence of January, November and December effects with none indicating the presence of the April effect in the Indian stock market. This presence would have confirmed the ‘tax-loss-selling’ hypothesis with ‘turn-of the-year’ effect, even as the financial year in India closes in the month of March. The findings suggest, that there is no –turn-of-the-year effect as the returns in April are not anomalous.

The presence of such an anomaly in the Indian stock market has two implications. Firstly, over the chosen study period; the Indian stock market does witness seasonal patterns and therefore, is weak form inefficient. Secondly, these seasonal patterns or anomalies can be exploited by investors to earn above average returns by timing their investments, which enables them to enter the market at a lower acquisition cost. This lower cost of acquisition, in turn, enhances the overall return.

This study was an attempt to uncover the seasonal patterns in monthly returns. It can be taken further by investigating the cyclical patterns (which are observed over a period of 2-4 years) in specific sectors and stocks in the Indian stock markets.

REFERENCES

Bhattacharya, K., Sarkar, N., & Mukhopadhyay, D. (2003) ‘Stability of the Day of the Week Effect in Return and In Volatility at the Indian Capital Market: A GARCH Approach with Proper Mean Specification’, Applied Financial Economics, 13:8, pp. 553-563.

Branch, B. (1977) ‘A Tax Loss Trading Rule’, The Journal of Business, 50:2, pp. 198-207.

Chakrabarti, G., and C. Sen (2007) ‘November Effect: An Example of Calender Anomaly in Indian Stock Market’, West Bengal University of Technology, Kolkata, India. Online at: http://ssrn.com/121606.

Malkiel, B.G., & Fama, E.F. (1970) ‘Efficient Capital Markets: A Review of Theory and Empirical Work’, The Journal of Finance, 25:2, pp. 383-417.

Guidi, F., Gupta, R., & Maheshwari, S. (2011) ‘Weak-Form Market Efficiency And Calendar Anomalies For Eastern Europe Equity Markets’, Journal of Emerging Market Finance, 10:3, pp. 337-389.

Kaur, H. (2004) ‘Time Varying Volatility in the Indian Stock Market’, Vikalpa, 29:4, pp. 25-42.

Ignatius, R. (1992) ‘The Bombay Stock Exchange: Seasonalities and Investment Opportunities’, Indian Economic Review, pp. 223-227.

Keong, L.B., Yat, D.N.C., & Ling, C.H. (2010) ‘Month of the Year Effects in Asian Countries: A 20-Year Study (1990-2009)’, African Journal of Business Management, 4:7, pp.1351-1362.

Pandey, I.M. (2002) ‘Is There Seasonality in the Sensex Monthly Returns’, IIMA Working Paper, IIM Ahmedabad.

Parikh, A. (2009) ‘The December Phenomenon: Month of the Year Effect in the Indian Stock Market’, NSE News, January.

Patel, J.B. (2011) ‘Calendar Effects in the Indian Stock Market’, International Business & Economics Research Journal (IBER), 7:3.

Poshakwale, S. (1996) ‘Evidence on Weak Form Efficiency and Day of the Week Effect in the Indian Stock Market’, Finance India, 10:3, pp. 605-616.

Raj, M., & Kumari, D. (2006) ‘Day Of The Week And Other Market Anomalies In The Indian Stock Market’, International Journal of Emerging Markets, 1:3, pp. 235-246.

Reinganum, M.R. (1983) ‘The Anomalous Stock Market Behaviour of Small Firms in January: Empirical Tests for Tax-Loss Selling Effects’, Journal of Financial Economics, 12:1, pp.89-104.

Michael, R. and Kinney W. (1976) ‘Capital Market Seasonality: The Case of Stock Returns’, Journal of Financial Economics 3, pp. 379-402.

Sah, A.N. (2009) ‘Stock Market Seasonality: A Study of the Indian Stock Market’, Electronic copy available at: http://ssrn. com/abstract.

Starks, L.T., Yong, L., & Zheng, L. (2006) ‘Tax-Loss Selling and the January Effect: Evidence from Municipal Bond Closed-End Funds’, The Journal of Finance, 61:6, pp. 3049-3067.

Wachtel, S.B. (1942) ‘Certain Observations on Seasonal Movements in Stock Prices’, The Journal of Business of the University of Chicago, 15:2, pp.184-193.

Garima Gupta, Doctoral Candidate, IIFT Delhi. Email: gar imagupta.

iift@gmail.com.