AN ANALYTICAL STUDY ON ASSET UNDER MANAGEMENT OF LIFE INSURANCE COMPANIES IN INDIA

Insurance plays an important role in creation of wealth in the economy. The insurance sector, on account of the huge size of the funds that it attracts, plays a crucial part in the development of the same. These funds need necessarily be invested in such a manner so as to equip the insurers to meet their obligations to their policyholders, as and when the claims obligations arise. Therefore, this study is conducted to investigate the investments of life fund, pension and general annuity funds, group funds and of unit linked funds by Indian Life Insurance Industry. By using statistical tools such as percentage share, mean, standard deviation, coefficient of variation and frequency distribution it is observed that LIC is consistently using funds for investment as compared to private sector life insurance companies which reflects the efficient investment behaviour of Life Insurance Corporation of India.

Introduction

The Insurance Act 1938, defines life insurance business as the business of effecting contracts of insurance upon human life, including any contract whereby the payment of money is assured on death (except death by accident only) or the happening of any event insured by the contract. In other words, a life insurance contract is a contract in which the insurer agrees to pay to the assured an agreed sum of money in consideration of a certain premium (either in lump sum or any other periodical payment), on the death of the insured or on the expiry of a specified period of time, whichever is earlier. Life insurance contracts are contingent contracts as in case of life insurance the payment is certain. The event insured against is sure to happen, though the time of its occurrence is uncertain. Thus, under a whole life assurance, the policy money is payable at the death of the assured and under an endowment policy, the money is payable on the maturity of the policy or on his death, in case if that occurs earlier.

Insurance is thus defined as a co-operative device to spread the loss over a number of persons who are exposed to it and agree to ensure themselves against that risk. Risk is uncertainty of a financial loss. It is collective bearing of risk as it involves pooling of risk. Insurance is a social device which provides compensation for adverse conditions, the payment for which is made from the accumulated contributions of all the parties.

Fund wise Investment of Life Insurers:

Insurance companies come to the market with a variety of plans having different objectives to take care of varied financial needs of the policyholders. Therefore, investment objectives, strategies and composition of funds differ from the basic objectives of life insurance plans. Accordingly, investment of life insurance companies has been classified by Insurance Regulatory Development Authority of India (IRDA) as investment of Life Funds, Pension and General Annuity Funds, Group excluding Group Pension and Annuity Fund and Unit Linked Fund.

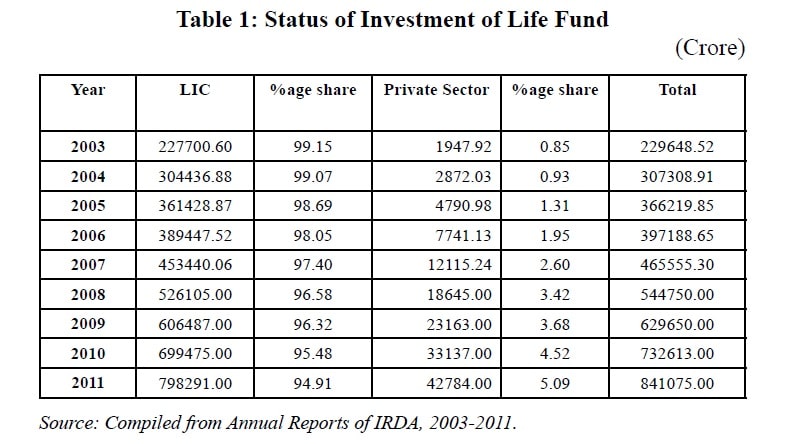

Source: Compiled from Annual Reports of IRDA, 2003-2011.

Life fund has been invested in Central Govt. Securities other than the approved securities investment subject to exposure norms, and other than approved investments (OTAI). It can be observed from the above table that in 2003, Rs. 229648.52 crore was invested in life fund which increased to Rs. 841075.00 crore in 2011. Investment in life funds by LIC is much more as compared to private sector and is increasing rapidly as well but percentage share of LIC in total investment in life funds is decreasing continuously. This indicates the rapid growth of private sector life insurance companies.

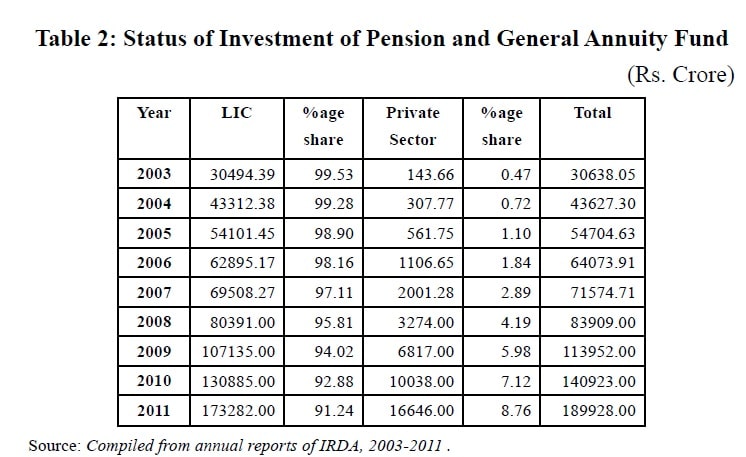

Source: Compiled from annual reports of IRDA, 2003-2011 .

*Since 2008, due to IRDA (investment) (Fourth Amendment), the amount of Pension and General Annuity Group Fund is given.

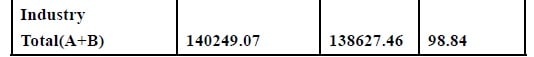

Investments in Pension and General annuity and Group fund increased to Rs 189928.00 crore in 2011 from Rs 30638.05 crore in 2003. This may be due to increased sales of pension products and mobilization of savings since opening up of life insurance to private companies. Most of the life insurance companies including LIC have launched pension and retirement plans which boasted of pension sales and enhanced investible funds. Further, contribution made by LIC in total investment of Pension and General and Group annuity fund is larger than that of private sector life insurance companies. In total Pension and General annuity and Group fund investment of life insurance industry, major contribution was made by LIC which was 99.53 percent; 99.28 percent; 98.90 percent in years 2003, 2004, 2005 and so on. The reason for this declining percentage in successive years may be the entry of new private sector companies in life insurance industry.

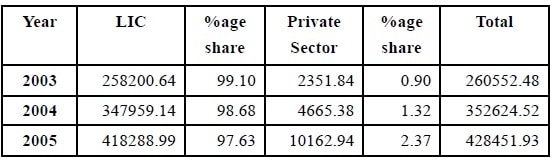

Source: Compiled from annual reports of IRDA,2003-2011.

*Since 2008, due to IRDA (investment) (Fourth Amendment), the amount of Unit linked Fund is given.

Significant development has taken place in Unit Linked segment in terms of growth in sales leading to increase in investible funds, favorable macro economic environment, high growth in GDP and the boom in stock market strangely supported the growth in unit linked segment, which has been reflected in growth of investment. Total, Unit Linked funds in 2003-04 increased from Rs 265.91 crore in 2003 to Rs 399115.00 crore in 2011.

This was a very remarkable development in terms of business growth, but more than that it has its own impact on stock market. It may be because of larger proportions of its investment in stock market securities particularly in equity.

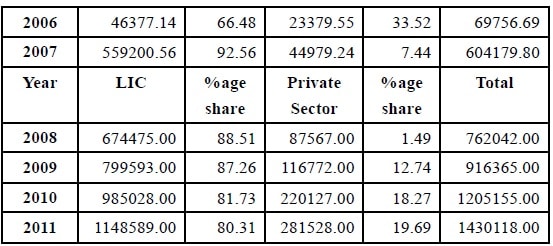

Table 4: Status of Investment of Total of All Funds

(Rs. Crore)

Source: Compiled from annual reports of IRDA, 2003-2011.

Total investment by life insurance industry in all funds has increased over the years. Total investment in all funds was Rs 260552.48 crore in 2003 and increased to Rs 1430118 crore in 2011. This increased investment indicates the growth of life insurance business. Considering the percentage share of total investment of all funds, it is clear that percentage share of private sector life insurance companies is increasing over the years indicating growing market share of private insurers.

Life insurance companies with huge investment in capital market have significantly impacted the depth and market movement. As noted earlier together they have invested huge amount in debt and equity market and to a great extent influenced the movement of indices. In fact, insurance companies are emerging as strong players in the Indian stock market. This is an indication of growing importance of life insurance companies in the stock market which is likely to increase in the years to come.

Review of Literature:

Stowe (1978) presented a simple chance-constrained model of life insurance company portfolio choice and several hypotheses derived from the model are examined using a cross-sectional, time series panel of 15 annual observations for 92 large U.S. life insurance companies. In addition to the usual yield variables, non-yield variables such as the relative amount of surplus and the cost of reserve liabilities are significant determinants of the composition of life insurance company portfolios. Portfolio adjustments were found to occur more rapidly than previously reported in the literature.

Buser & Smith (1983) stated the ownership of life insurance may be modeled as a portfolio problem in which the return on the life insurance contract is negatively correlated with the return on a claim to future wage income. The mean-variance model developed in the paper uses such a framework to express the optimal amount of insurance in terms of two components: the expected value of the wage claim and the risk return characteristics of the insurance contract. The model thus offers an appealing way to formulate the life insurance problem in a portfolio context. Implications of the model for the functioning of a life insurance market are examined and the existence of accidental death contracts is explained. Kleiman & Sahu (1991) examined the attractiveness of the equity portfolios of life insurance companies as an alternative investment to mutual funds. In particular, this study analyzes the risk-adjusted investment performance of the stock portfolios of life insurance companies, attributable to their stock selection and market timing abilities. Using conventional measures of risk-adjusted portfolio performance, it was found that life insurance companies exhibit performance similar to mutual funds. The evidence suggests that the life insurance companies, like their mutual fund counterparts, fail to exhibit differential stock selection or market timing abilities that are statistically significant. While the risk adjusted investment performance of the two investment vehicles is similar, the variable annuity contracts of life insurance companies may offer an edge over mutual funds due to their ability to defer taxes. Adams (1996) examined the relationship between the investment earnings of life insurance firms in New Zealand and their organisational characteristics. Using data for the period 1988–1993, a pooled Weighted Least Squares regression model is estimated. Consistent with expectations, the empirical results indicate that investment earnings were higher for stock companies than for mutuals. They were also positively associated with the size, leverage and underwriting risk of life insurance firms. Life insurance firms holding proportionately more financial than non-financial assets have low investment yields. The liability structure of life insurance firms was unrelated to their investment earnings. Ranade & Ahuja (1999) presents an overview of Life Insurance operations in India, and have identified the emerging strategic issues in light of liberalisation and the impending private sector entry into insurance. The need for private sector entry has been justified on the basis of enhancing the efficiency of operations, achieving a greater density and penetration of life-insurance in the country, and for a greater mobilisation of long term savings for long gestation infrastructure projects. In the wake of such coming competition, the LIC, with its 40 years of experience and wide reach, is in an advantageous position. However, unless it addresses strategic issues such as changing demography and demand for pensions, demand for a wider variety of products, and having greater freedom in its investments, LIC may find it difficult to adapt to liberalised scenario. Pant (1999) stated that liberalisation of the insurance sector in India will see the increasing involvement of the large and powerful insurance companies of the world in the Indian insurance industry. This involvement is essential for the growth of the Indian insurance sector in particular and the Indian economy in general. Such an effort would, however, require the support of a clearer and more cogent legislation than the Insurance Regulation and Development Bill 1999. Tripati (1999) developed a proper perspective of the ongoing debates on the privatisation and globalisation of the insurance sector in a systematic study of the structure and pattern of growth of the Indian insurance industry. An analysis of pattern of growth of life insurance industry since its nationalisation in 1956 has been carried out. This article goes into the operating results of the Life Insurance Corporation and their macro-economic importance. The main focus of the article is the pattern and growth of life insurance business in India. Specifically, it deals with the analysis of growth of new business, business in force, income and outgo (financial outflow) life fund, i.e., institutionalisation of savings, and business by different zones of LIC. Finally, these indicators are compared with the related macro variables. Berry- Staolzle, et al (2007) investigated the benefit of investing in hedge funds. The effect of the insurer’s liability structure on the decision regarding investment in hedge funds was considered. It was done using a simplified model of a life insurance company with cliquet-style interest rate guarantees and three investment opportunities. The specific characteristics of hedge fund returns with a three dimensional AR(1) GARCH(1,1) asset model was addressed in analysis. The results reveals first, that it is advantageous for life insurers to invest in hedge funds, and second, that financially weak insurers have a higher incentive to invest in hedge funds. Gerstner, et al (2008) explore that new regulations and a stronger competition have increased the importance of stochastic asset–liability management (ALM) models for insurance companies in recent years. This paper proposes a discrete time ALM model for the simulation of simplified balance sheets of life insurance products. The model incorporates the most important life insurance product characteristics, the surrender of contracts, a reserve-dependent bonus declaration, a dynamic asset allocation and a two-factor stochastic capital market. All terms arising in the model can be calculated recursively which allows an easy implementation and efficient simulation. Furthermore, the model is designed to have a modular organization which permits straightforward modifications and extensions to handle specific requirements. In a sensitivity analysis for sample portfolios and parameters, the study investigated the impact of the most important product and management parameters on the risk exposure of the insurance company and show that the model captures the main behaviour patterns of the balance sheet development of life insurance products. Chatterjee & Sinha (2009) estimated cost efficiency of the life insurance companies operating in India for the period 2002-03 to 2006-07 using the new cost efficiency approach suggested by Tone (2002). The results suggest an upward trend in cost efficiency of the observed life insurers between 2002-03 and 2004-05. However, the trend was reversed for the next two years i.e., 2005-06 and 2006-07. This has been so because of the fact that during the initial years of observation, mean cost efficiency of the private life insurers was rising but the trend was reversed in 2005-06 and 2006-07. Sinha (2010) compares 15 life insurance companies operating in India for 2005-06 to 2008-09 using the old and new revenue maximizing approach. The difference between the two approaches lies in the specification of the production possibility set. In both the approaches, only the Life Insurance Corporation of India (LIC) was found to be efficient for the observed years followed very closely by Sahara life. However, since in the old approach, the technically inefficient firms are penalized very harshly, the grand mean technical efficiency score is less than 50% to that in the new approach. City of London Corporation(2011) illustrated effect of pension funds and insurance companies on the development of capital markets. The rise of pension funds and insurance companies in the US and the UK drove the emergence of liquid and stable stock markets and a sophisticated corporate bond market. In most of continental Europe institutional investors historically played a smaller role, but recently they have grown in importance and have facilitated a shift away from bank financing. In India and China pension funds and insurance companies have so far been minor players in capital markets. But the potential for them to take up a larger role and contribute to the deepening and stabilization of the stock and corporate bond markets is huge. Firstly, the pension and insurance systems are still underdeveloped. High growth is expected as people become wealthier and the financial system.

Research Methodology:

Objectives of the study:

The study aims to explore the investments of Life fund, Pension and General annuity funds, Group funds and in Unit linked funds by life insurers.

Nature and Source of Data:

The nature of data which is collected and used for this research is secondary in nature. The relevant and required data has been collected from journals, annual reports of IRDA for selected years and through various search engines.

Sample Selection and Time Period of the study:

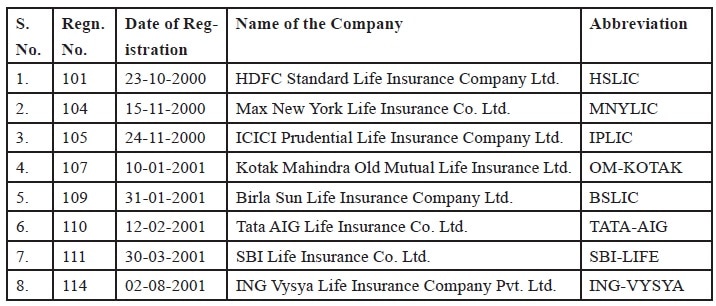

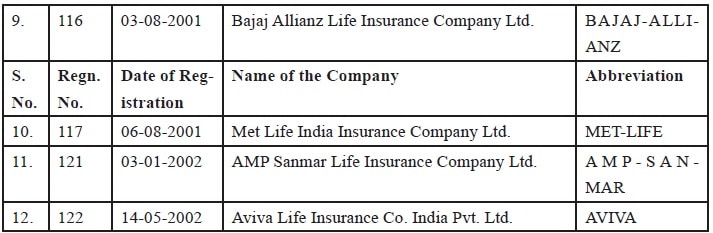

Public sector (LIC) and all private companies are selected for the study except those private companies who have started their operations in 2003 and even their after. Further the time period selected for the study is nine years i.e.2003-04 to 2010-11. This is due to non availability of consistent data before the financial year 2003-04.The description of selected life insurers for the study is as follows:

Profile of Private Sector Life Insurance Companies

Source: Compiled from the Annual Reports of IRDA, 2003-2011

Tools and Methods of Data Collection:

The present study involves calculation of Mean, Standard Deviation, Coefficient of Variation and Frequency distribution to evaluate the investment of life insurance companies.

ANALYSIS OF ASSET UNDER MANAGEMENT

Assets Under Management (AUM): Sometimes also called Funds Under Management (FUM), measures the total market value of all the financial assets which a financial institution manages on behalf of its clients. This metric is very popular within the financial industry and is a sign of size and success of any firm against its competition. Life Fund: Life fund is a pool of money and/or assets such as property or share held by a fund in to which, life assurance policyholder’s premiums are paid and from which claims are made. Life funds are those which are accessed via. Investment bonds, saving and protection plans. A detailed description of life fund investments by various life insurers is depicted in table 5.

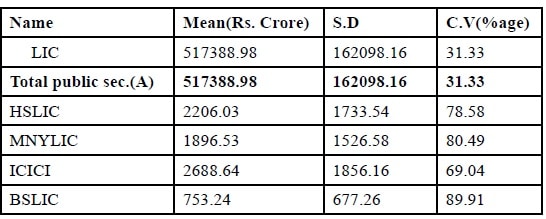

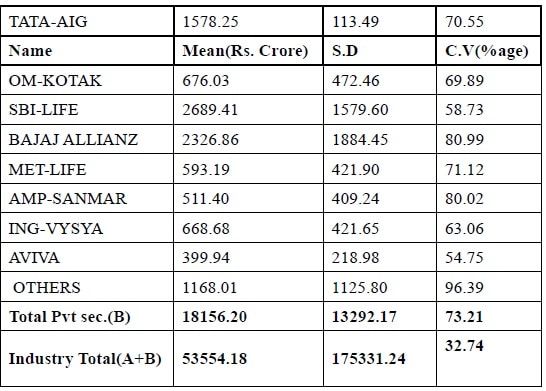

Table 5: Total Investment in Life Fund

Source: Calculated using data from Annual Reports of IRDA for the years 2003-04 to 2010-11.

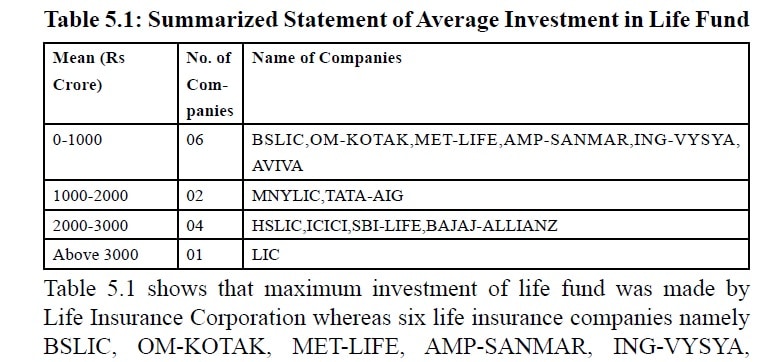

It is crystal clear from the above table LIC made maximum investment of Life fund i.e. Rs.517388.98 crore with minimum coefficient of variation of 31.33% in life insurance industry which indicates that investments made by LIC in Life fund is more consistent in comparison to private sector life insurance companies. This may be due to large scale operations and high asset base of LIC. Among private sector life insurance companies, AVIVA life insurance made average investment of Rs.399.94 crore of life funds with C.V. of (54.75%). The above information is summarized in table 5.1 and table 5.2.

Table 5.1 shows that maximum investment of life fund was made by Life Insurance Corporation whereas six life insurance companies namely BSLIC, OM-KOTAK, MET-LIFE, AMP-SANMAR, ING-VYSYA, AVIVA invested least in terms of life fund among all life insurance companies and hence it is expected that, these companies may not be able to meet their claim obligations efficiently.

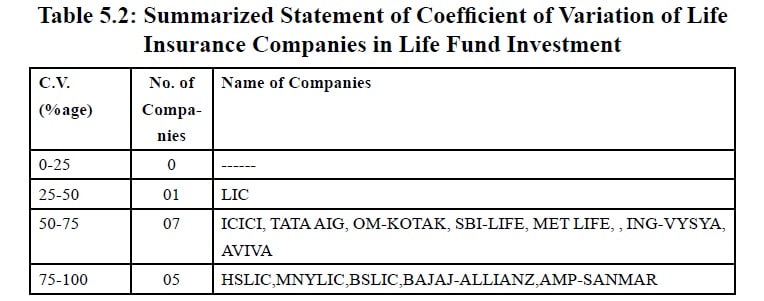

Minimum coefficient of variation was observed in case of LIC as is explained in table 5.2. BSLIC and AMP-SANMAR are two life insurers having minimum average investment of life fund with maximum coefficient of variation indicating their poor performance. Therefore, LIC emerges as a consistent player in terms of investment of Life fund.

Pension and General Annuity Fund: A Pension annuity converts the funds built up in the pension schemes in to a regular income. This income is then payable for rest of the life. Group funds are asset of mutual funds managed by a single company. The funds within group funds have different investment goals and/or strategy. Group fund is also known as Fund Family. However, because in Group funds, the same company manages the whole family, the individual investors may generally move money from one fund to another without extra commission or fees. This allows investors to be flexible in their own investment goals according to particular needs at a given time. Position of pension and general annuity of life insurance companies is presented in table 6.

Table 6: Total Investment in Pension & General Annuity Fund

Source: Calculated using data from Annual Reports of IRDA for the years 2003-04 to 2010-11.

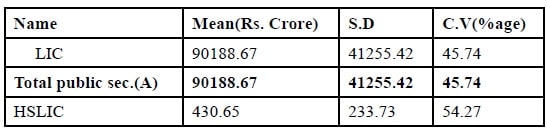

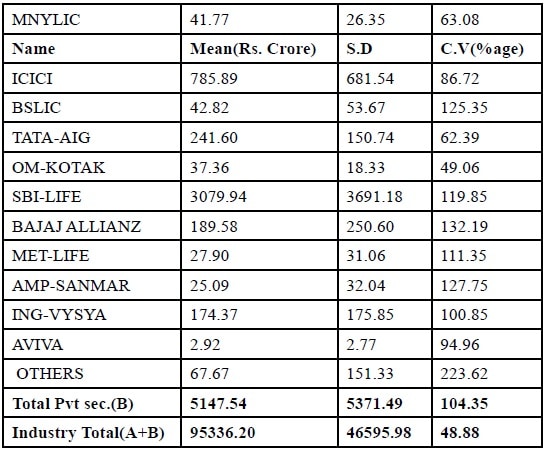

It is clear from the table that life insurance industry made an average investment of Rs. 95336.20 crore of pension and general annuity fund. Among all life insurance companies Life Insurance Corporation of India made maximum investment i.e. Rs 90188.67 crore with minimum coefficient of variation of 45.74% which indicates the consistent investment behaviour of LIC. BAJAJ-ALLIANZ life insurance company reported maximum coefficient of variation (132.19%) followed by AMP-SANMAR (127.75%) and SBI-LIFE (119.85%) indicating their inconsistent investment pattern.

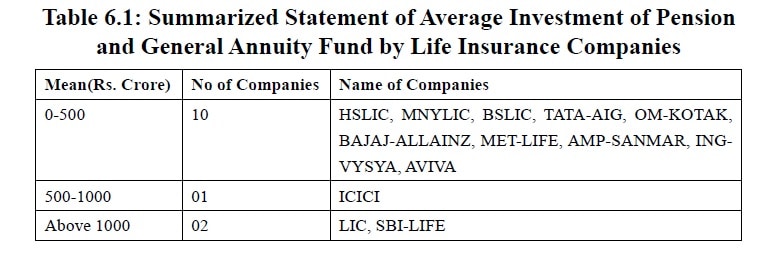

The same information has been summarized and presented in table 6.1 and 6.2.

As is clear from table 6.1, Here again, LIC is observed to be the leading player followed be SBI and ICICI. Rest of Private sector life insurance companies made least investment of the above stated fund.

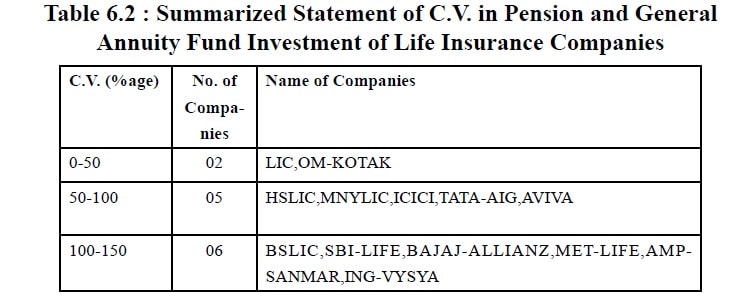

Minimum Coefficient of Variation was observed with LIC and OMKOTAK life insurance company where as LIC also made maximum average investment of Pension and General Annuity Fund highlighting consistent investment behaviour of LIC.

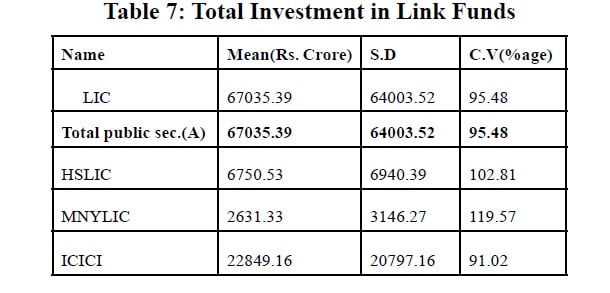

Linked Funds: A unit linked insurance plan (ULIP) is a type of insurance plan where the cash value of a policy varies according to the current net asset value of the underlying investment asset. It allows protection and flexibility in investment, which are not present in other types of life insurance such as whole life policies. The premium paid is used to purchase units in investment assets chosen by the policy holder. Investment behaviour of various life insurance companies using linked funds is presented in table 7

Source: Calculated using data from Annual Reports of IRDA for the years 2003-04 to 2010-11.

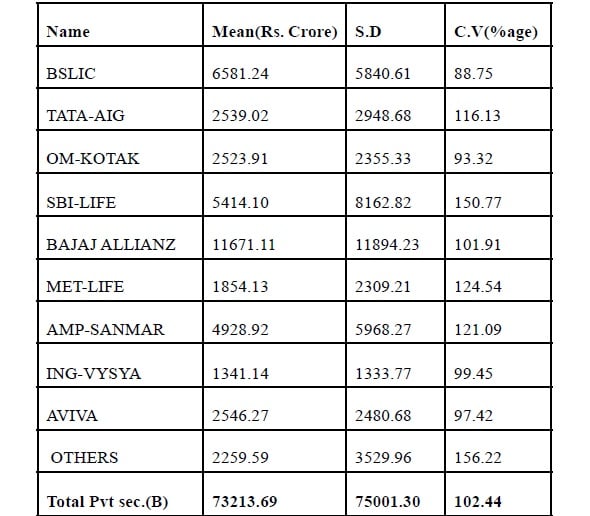

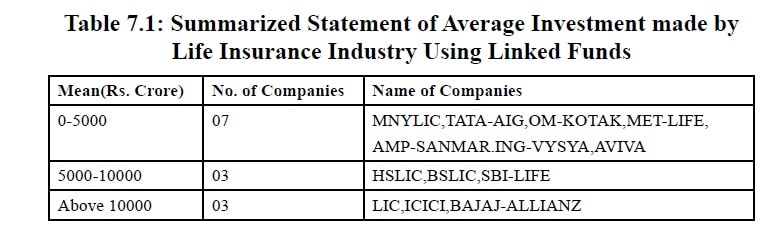

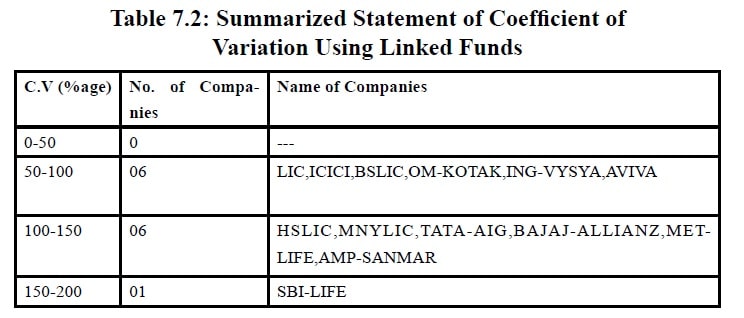

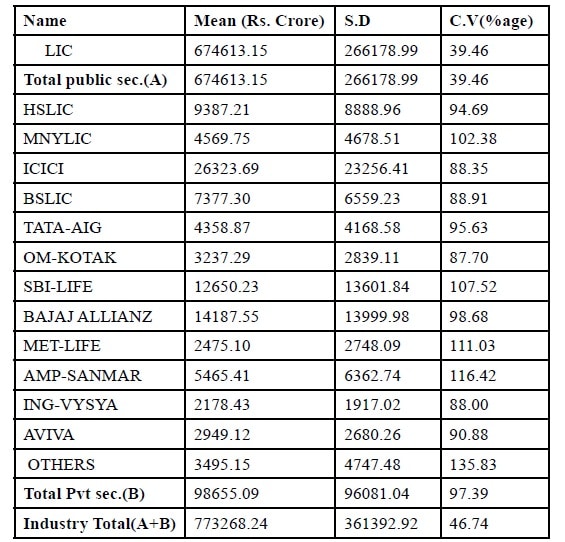

A high degree of variation in investment behaviour is observed from the above table. A least coefficient of variation (88.75%) is recorded in respect of BSLIC which in itself represents inconsistency of investment of linked funds by BSLIC. As is noticed from the above table, the C.V. is 95.48% in respect of Life Insurance Corporation as compared to 102.44% of private sector Life Insurance Industry which indicates that more consistent investment was made by LIC using ULIP funds as compared to private sector Life Insurance Industry. A minimum C.V. of 88.75% and 91.02% is observed in respect of BSLIC, ICICI. A brief description of above table is presented in table 7.1 and 7.2 given below:

Table 7.1 explains that three life insurers i.e. LIC, ICICI, BAJAJALLAINZ made highest average investment using linked fund which is more than Rs. 1000 crore whereas seven life insurers made investment less than Rs.5000 crore.

It can be traced from table 7.2, SBI-LIFE Insurance Co. Ltd. Is the only life insurer reporting highest Coefficient of Variation with in the range of 150-200 percent. LIC including five other private sector life insurance companies showed C.V in the minimum range of 50-100 percent. This again indicates the best performance of LIC among all life insurance companies operating in India.

Total (All Funds): All funds includes sum of life funds, pension and general annuity fund, group fund and unit linked funds. Table 8 represents the amount of investment made using all funds:

Table 8: Total Investment of All Funds

Source: Calculated using data from Annual Reports of IRDA for the years 2003-04 to 2010-11.

It is clear from the above table that LIC consistently made investments from received funds, and recorded 39.46% of co-efficient of variation whereas investment behaviour of private sector Life Insurance players was quite inconsistent. The information from table 8 is summarized and presented in table 8.1:

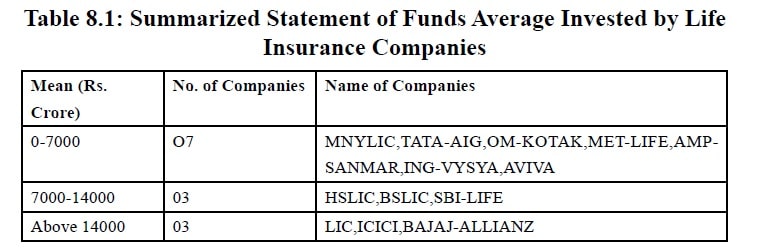

Considering average investment of funds invested by life insurance companies, it was found that LIC, ICICI, BAJAJ-ALLAINZ made average investment of more than Rs.14000 Crore and Investment below Rs. 7000 Crore was made by MNYLIC, TATA-AIG, OM-KOTAK, MET-LIFE, AMP-SANMAR, ING-VYSYA and AVIVA.

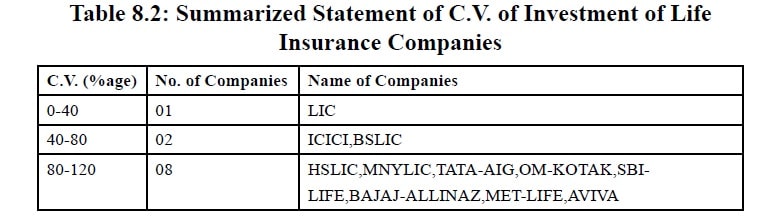

Table 8.2, entitled summarized statement of C.V. of investment of life insurance companies. It was highlighted that Life Insurance Corporation of India falls under bracket of 0-40 percent which itself is minimum followed by ICICI and BSLIC 40-80 percent. High variation in investments is observed in respect of rest of private insurers.

Conclusion

Least volatility in investment of life fund was observed in respect of LIC (31.33%) during 2003-04 to 2010-11 years which indicate the consistent investment made by LIC using life funds. In case of Pension & General annuity and Group funds LIC again made maximum investments with minimum Variations. As far as, investment of ULIP funds is concerned it is minimum in respect of ICICI with maximum average investment among private life insurers. Among rest of the companies, maximum average investment was made by LIC of ULIP funds. Considering total investment made using all kind of funds, it is found that LIC is consistently using funds for investment as compared to private sector life insurance companies.

Recommendations: Some recommendations given below to enhance the return to the investor:

Investments of life insurers should be pooled together in a single company in order to part the risk. Life insurers should run the skill development program for the employees engaged in investing funds so as to enhance the return to investor. Restrictions imposed on insurers for investment of funds should be lowered to provide far reaching choice to the investor.

Implications:

The study aims to analyze investment pattern of life insurance companies in India. By working on its respective weaker part, the companies will be able to meet their claim obligations effectively and efficiently which in turn may lead to greater customer satisfaction and ultimately the companies may enjoy increased premium income.

Future Expectations from the sector:

Asset Under Management of Life Insurers by 2020:

Assets Under Management (AUM) of life insurers will almost treble to $1 trillion (nearly Rs 60 lakh crore) by 2020 from the current Rs 19.4 lakh crore, according to projections by the Life Insurance Council. Life Insurance penetration is expected to grow from the current 3.2 per cent to 5 per cent by 2020 and the industry will employ about 5 lakh from the current 2.41 lakh, according to Life Insurance Council. Expected CAGR of life insurance industry will be 12-15 per cent in the next 3-5 years.

The net household financial savings could reach around 30 per cent in the next 3 years from the current level of 23.1 per cent (FY 2011-12), which will benefit life insurance as it is the second most preferred financial instrument, Manickam said and added that the industry was expecting about $10 billion foreign direct investment (FDI) into the sector by 2020. “Once life insurance penetration comes in the rural area would increase from 72 per cent to 80 per cent and thereby contributing employment opportunities.

REFERENCES

Adams, M. (1996) ‘Investment earnings and the characteristics of life Insurance funds-Newzealand’s Evidence’, Australian Journal of Management, 21:1.

Berry, Staolzle Thomas., Hendrik, Kiaaver., Shen,Qiu (2007) ‘Should Life Insurance Companies Invest in Hedge Funds’, (online) (cited 5 March 2014). Available from <URL:http://www.aria.org/meetings/2007papers/IIID%20-%203%20-%20Berry Stoelzle.pdf>.

Buser Stephen, A., Smith, Michael L. (1983) ‘Life Insurance in a Portfolio Context’, Insurance, Mathematics and Economics, 2, pp. 147-157

Chatterjee, B., Sinha, R.P. (2009) ‘Are Indian Life Insurance Companies Cost Efficient’ (online) (cited 20 February 2014). Available from <URL: http://ssrn.com/abstract=1391904>.

Pant, Niranjan (1999) ‘Insurance Regulation and Development Bill: An Appraisal’, Economic and PoliticalWeekly, 34:45, pp. 3166-3169.

Ranade, Ajit.,Ahuja, Rajeev. (1999) ‘Life Insurance in India : Emerging Issues’, Economic and Political Weekly, Money, Banking and Finance, 34:3/4, pp. 203-205 & 207-212.

Rao, D Tripati. (1999) ‘Life Insurance Business in India: Analysis of Performance’, Economic and Political Weekly, 34:31, pp. 2174-2181.

Robert, T. Kleiman., Anandi, P Sahu. (1991) ‘Life insurance Companies as Investment Managers : New Implications for Consumers’, Financial Services Review, 1:1, pp. 23-34.

Stowe, D.John, (1978) ‘Life Insurance Company Portfolio Behavior’, The Journal of Risk and Insurance,45:3, pp. 431-447.

Thomas, Gerstner., Michael, Griebel., Markus, Holtz., Ralf, Goschnick., Marcus, Haep. (2008) ‘A General Asset Liability Management Model for the Efficient Simulation of

Portfolios of Life Insurance Policies’, Insurance: Mathematics and Economics, 42: 2, pp. 704-716.

Prof. Neelam Dhanda is in Department of Commerce, Kurukshetra University, Kurukshetra.

Ms. Nancy Gulati is Research Scholar, Department of Commerce, Kurukshetra University, Kurukshetra.