The Role Of Customer Relationship Management And Relationship Maintenance On Customer Retention- An Exploratory Study

A Customer Relationship Management (CRM) model assists a firm in maintaining effective relations with their customers. A good number of researchers focused on CRM; a move towards the consolidation of CRM and relationship maintenance (RM) which in existing literature is thin. Hence, the main objective of this research is to examine the role of CRM and RM on customer retention (CR). In this research, a qualitative research approach has been taken, where ten relationship managers of different banks of Bangladesh have been interviewed, to determine the primary factors along with some other relevant variables. A content analysis technique has been applied to further develop a research model and analyze the data. The interview outcomes identified sixteen major variables that affect CR. The study also includes research and managerial implications of the model.

INTRODUCTION

A good number of banks are developing customer focused strategies and also investing in customer relationship management (CRM) technologies, with an intention to retain customers and also to maximize profits observed Eid (2007). CRM has become the primary concern for different firms, irrespective of their size and nature quoted Becker et al. (2009). Nevertheless, factors that constitute CRM are an issue of sizable debate stated Krasnikov et al. (2009). Relationship management and maintenance issues have received significant attention in the field of academic and professional research. The significanc e of combing CRM and relationship maintenance (RM) issues has been mentioned by a good number of researchers like Riemann et al. (2010). Yet, there is minimum evidence to argue that banks are systematically incorporating RM issues into their CRM strategies.

The primary intent of this study is to find out the key issues related to CRM and relationship maintenance (RM) with special reference to the banking industry. This study also aims to identify the influenc e of CRM on RM and finally on customer retention (CR ). This paper begins with a review of extant literature related to CRM, RM and CR; followed by an extensive discussion of their relationship.

Research Background

The banking sector is one of the growing sectors of Bangladesh, which is characterized by severe competition. Moreover, most of the banks offer somewhat similar kind of services, which may not be suitable for all types of customers. Moreover, a good number of banks failed to offer expected services at reasonable prices and thereby dissatisfaction arises. Therefore, to reduce the level of dissatisfaction relationship development and maintenance should be the primary goal of every bank opined Eid (2007). It is evident that a good number of nationalized and private commercial banks do not have extensive CRM systems, which eventually result in poor retention rates. Researches in the Bangladesh context, investigated the impact of CRM practices on profitability, where CRM has been narrowly focused upon as a simple technology solution. Records show that the failure rates of CRM projects are high observed Ryals(2005). Finnegan and Currie (2010) argue, that many firms failed to acquire business benefits from CRM deployment; which eventually indicates that CRM has been thinly focused either as a technological investment as stated by Jayachandran et al. (2005), or an organizational investment stated Roberts et al. (2005), or an investment in software technology observed Reinartz et al. (2004) or a strategic aspect as described by Payne and Frow (2005); undermining its multidimensional and collaborative aspects. Therefore, researchers such as Becker et al. (2009) and Chang et al. (2010) suggested, that an extensive and holistic approach of customer relationship management and maintenance is necessary, to develop effective and durable relationships with bank customers. Based on available resources, it can be argued that in the Bangladeshi banking industry context, very few researches focused on effective CRM implementation. Hence, it is essential to develop a comprehensive and collaborative CRM framework, comprising of the relevant CRM and relationship maintenance elements, suitable for the banking industry of Bangladesh.

Literature Review and Conceptual Framework

Customer Relationship Management (CRM)

Research on CRM has gained significant momentum lately by Zablah et al. (2004). Nevertheless, issues like components and outcomes of CRM, and a generalized definition of CRM in existing literature are till now scrappy stated the authors. For example, Yim et al. (2005) argued, that CRM originated from the combination of three aspects: customer orientation, relationship marketing and database marketing, while Zikmund (2000) illustrates a more technology focused perspective. In general, Reinartz et al (2004) stated, that CRM stresses upon the collaboration of activities necessary to develop and maintain durable and profitable relationships with customers. CRM assists in managing different customer touch points and in disseminating customer knowledge throughout the organization opined Robinson et al (2011). Campbell (2003) argued that an organization needs to develop a relationship management and maintenance system, which ultimately helps them in acquiring sufficient customer information, highly required for offering market oriented and customer centric offerings. CRM can be classified in many ways, like operational and analytical CRM as described by Peppers and Rogers (2004); and process CRM, consisting of three close related stages, such as initiation, maintenance and termination stated Reinartz et al.(2004). The above classification refers to the fact that, successful implementation of CRM largely depends on an organization’s own understanding and utilization of CRM. Based on previous research conducted by Eid (2007) and Becker et al. (2009) this study conceptualizes CRM as a multi-dimensional aspect, consisting of customer orientation, a customer-centric management system and technology.

Customer orientation explicitly placing the customers at the centre of all the firm’s activities is a fundamental element of organizational environment required for successful implementation of CRM. A customer centric management system accelerates the use of CRM technology with the support of employees stated Chang et al. (2010). IT can facilitate and enhance customer relationships focusing on customization, through the deployment of sophisticated customer relationship management (CRM) systems. Technological issues are also important and one of the drivers of CRM success opined Chen and Popovich (2003); and Roberts et al. (2005). In this regard it can be noted that, the RBV of the firm directs us towards the importance of IT observed Barney (1991) and also has been considered as an important framework for measuring IT performance stated Ray et al. (2005). Individual employees are the building blocks of customer relationships pointed out Chen and Popovich (2003). Accordingly Gholami and Rahman (2012) mentioned that the difficult phase of CRM implementation is not the technology, but the people.

Relationship Maintenance (RM)

A previous study of social and interpersonal relationships focused on the definition of relationship maintenance (RM), while CRM and marketing literature merely focused on the dimensions of RM Relationship maintenance generally focuses on the effort of maintaining and continuing a relationship in its present condition. Majority of the scholars consider RM as an interpersonal process, which evolve just immediately after the finishing of the beginning phase; and continue for a long time stressing upon the stability of the relationship observed Baxter (1990); and Montgomery (1993). Durability and stability in a relationship requires the intention of the parties involved to be in a particular relationship, personal or professional; which may continuously change, adapt, or transform the nature of relational life.

Customer Retention (CR)

Customer retention can be defined as the propensity of the customer to stay with their service provider stated Chatura (2003). Many firms nowadays have difficulty in attracting new customers and thereby restructure internal activities to provide more attention to their existing customers opined Ahmad and Buttle (2002). In the recent competitive marketplace, one of the key objectives of a relationship marketing strategy is keeping customers forever stated Gustafsson et al. (2005). Retention occurs when customers make a long-lasting commitment with a sole service provider, dedicate resources to a particular seller and considers using their services for a long term view observed Gupta and Zeithaml (2006). If customers decide to leave, the bank cannot easily restore the past relationship, and the account is often lost forever. Customer retention is essentially significant for the growth and sustainability of the banks. Banks need to realize that customers may be kept for good and maintain an exceptional relationship with their provider, or they may develop multiple relationships with different banks and share their spending among different banks reasoned Cooil et al. (2007). Hence, banks need to know the needs and wants of the customers, and also need to take necessary steps to fulfill them.

Linking Customer Relationship Management (CRM), Relationship Maintenance (RM) and Customer Retention (CR)

Generally CRM enhances the duration of profitable relationships between organizations and customers observed Reimann et al. (2010) and customer orientation in particular, helps in building long lasting relationships as per Bentum and Stone (2005) by offering added value to the customers stated Narver and Slater (1990). CRM also improves the levels of customer satisfaction opined Lindgreen et al (2006), through developing, promoting and maintaining the relationship. Similarly, effective and relevant information from and about customers plays a vital role in developing and maintaining durable relationships. In this regard the implementation of CRM technology is expected to increase the ability of a firm in facilitating customer-firm interaction; and also in sustaining long-term and profitable customer relationships through the smooth sharing and coordination of information observed Jayachandran et al. (2005).

Effective and long lasting relationships with customers lead to better customer satisfaction said Palmer et al. (2005), increase sales and thereby retain customers for a long time as per observations of authors like García-Murillo and Annabi (2002). The same authors also highlighted the fact that, effective customer employee interaction helps customers make an informed decision, which eventually fosters customer satisfaction and in the long run helps in retaining existing customers The company will have a better understanding of the genuine needs and expectations of the customers through an improved understanding of the customer stated Gwinner et al. (2005). Customer service employees must acquire knowledge about customer needs to improve customer satisfaction observed Homburg et al. (2008). Furthermore, meeting customer needs through listening to them and making necessary changes will foster a firm customer relationship. When the firm has a good understanding of customer needs and expectations, it will be able to better serve its customers and thereby achieve better customer satisfaction and retention observed Palmer et al. (2005).

The above discussion leads to the following hypotheses:

Hypothesis 1: CRM has a significant impact on relationship maintenance.

Hypothesis 2: CRM has a positive and significant influence on customer retention. Hypothesis 3: Relationship maintenance positively influences customer retention.

Methodology

Research Technique and Sample

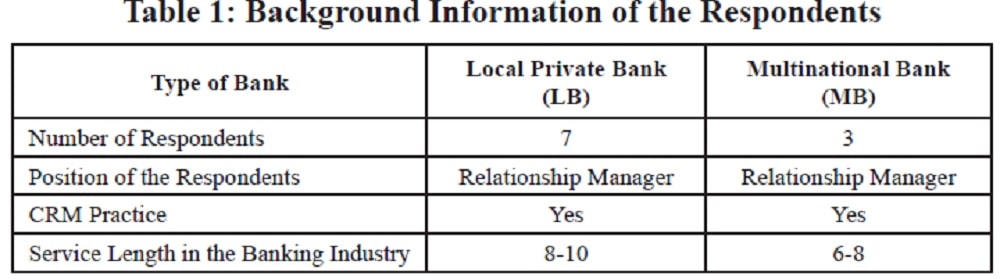

The field study research method has been used, as this study is generally qualitative in nature as propagated by Zikmund (2000). As the authors are interested to explore the role of CRM and relationship maintenance (RM) on customer retention (CR), the field study technique is the most suitable method. The field study method considers selecting respondents either in a random or non-random manner. The exploratory design starts with the qualitative phase of data collection to explore a theme stated Cresswell (2003). Data can be collected through different techniques in a field study approach, and in this study interview techniques have been applied to collect the required data from the selected respondents. In-depth interviews were conducted with relationship managers from ten different banks of Bangladesh. A purposive sample selection was employed, which is common with most qualitative research observed Farquhar and Panther (2008). Selection was limited to the major cities of Bangladesh, focusing on local private and multinational banks, as they offer the similar kind of financial products. Table-1 represents the demographic information of the respondents interviewed.

Data Collection Approach

A semi structured interview technique has been applied to collect data from respondents. Based on the conceptual framework, an interview guideline has been prepared. The primary purpose of a semi-structured interview framework is, to explore the role of CRM and relationship maintenance (RM) on customer retention in the banking industry. The semi-structured questions stressed upon the following areas of information: (i) essential understanding and measures of CRM and relationship maintenance (RM) issues; (ii) application and current practice of CRM; (iii) understanding the measures of customer retention; and (v) links between these factors.

The interview sessions have been scheduled according to the comfort of the interviewees to avoid interruption of their busy working schedules. Initially a pre-interview session has been completed through the telephone, so that respondents have an initial understanding of the overall interview process. A total of ten in-depth interviews needs to be conducted before saturation of themes occurred stated Strauss and Corbin (1998). McCraken (1988) argued that at least eight participants are required to generate insightful themes from depth interviews. Each interview took more than an hour. These sessions were audio recorded with prior permission, and were transcribed and thoroughly reviewed to find out the probable errors. Tapes were carefully listened to following instructions laid down by Strauss and Corbin (1998) and necessary corrections were made.

Data Analysis

For data analysis a number of tools and techniques are suggested in literature stated Miles and Huber man, (1994). Ssuitable tools need to be selected considering the objectives of the research. As this research is more of exploratory than of confirmatory in nature, content analysis seems to be the most appropriate tool to analyse the data observed Berg (2004). There were about a hundred pages of interview scripts to analyse. It is noted that all content analyses were done manually and a combination of inductive and deductive approaches was used to categorize the factors and variables concluded Berg (2004). The content analysis procedures were divided into two stages. Stage one dealt with single interview transcripts with the following steps suggested by Berg (2004, p.285).

Review the interview transcripts thoroughly and find the key themes and patterns.

• Produce labels/categories of these key words/phrases.

• Revise the labels in systematic categories to match the literature.

• Sort the interview transcripts into systematic categories.

• Look for the links and relationships among the factors from each interview transcript.

• Provide the tables of systematic categories with the factors and variables from each interview.

The next step of the content analysis is the integration of all the factors, variables, and links gathered from the interviews to develop a comprehensive model. The step-wise procedure was as follows stated Berg (2004, p. 286):

• Re-examine the individual interview transcripts with developed factors, variables, and the links from the first stage.

• Scrutinize the differences and similarities of the variables under each factor.

• Combine similar variables and generate a common name and also retain unique variables.

• Assimilate links among the factors.

• Develop the final tables of factors, variables and their links.

• Propose the comprehensive model.

Results and Implications

Background Information

Table 1 presents the demographic information of the relationship managers (RM) of different banks involved in this research. There were three RMs of three different multinational banks and rest of the seven respondents were from different local private banks. The selected respondents were highly experienced in customer relationship management, with 8-10 years of experiences in the banking industry. All the selected banks and the respondents are somehow familiar with CRM related issues; although the policies, practices and the use of technologies vary from bank to bank.

Factors and Variables

Four factors and twenty sub-factors were identified from the field study through an extensive content analysis process, which was discussed in the previous section. It is worth mentioning that the identified factors and subfactors have been classified where possible, following extant literature drawn from Narver and Slater (1990); Homburg et al.(2008); Jayachandran et al. (2005); and Chang et al. (2010). For example variables like, employee willingness and empathy towards customers are identified according to Jayachandran et al., (2005) which indicates, that frontline employees are the essential elements of customer relationship management. The respondents from different banks also argued that the employee’s role is highly important for any successful relationship. The sub-factors grouped under each factor carry to some extent proximate meaning more specific to CRM implementation, especially in the banking industry. For instance, the field study results shed light on the role of the frontline employee along with CRM technology on effective CRM implementation. The initiatives of employee to create, maintain, and nurture trustworthy relationships, and personal network play a key role in the successful implementation of CRM strategies.

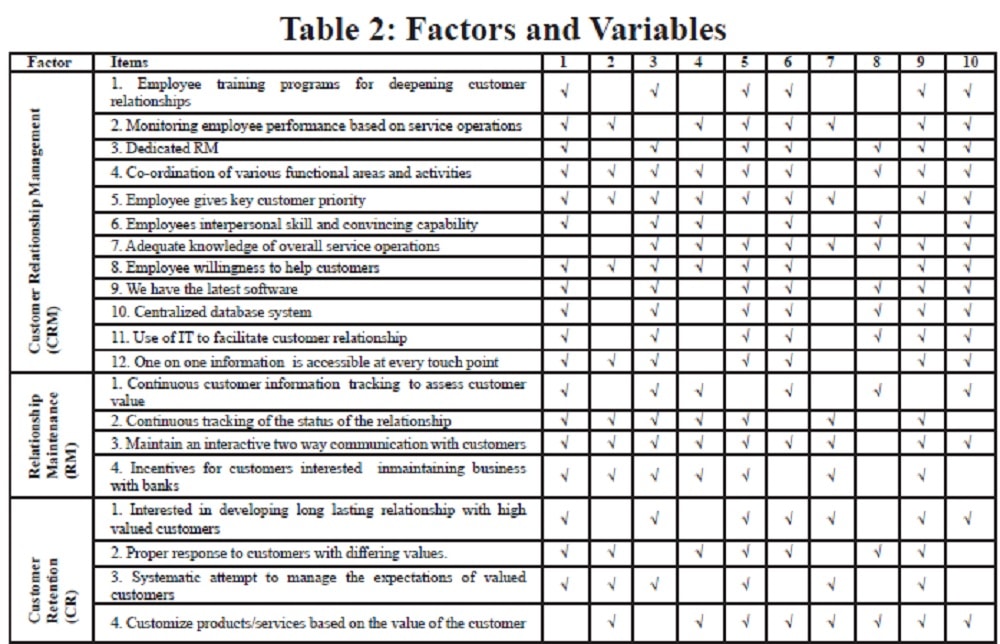

Table 2 shows the list of variables identified under each factor which are stated by the different relationship managers of different banks. It is essential to report that out of twenty identified variables, elevenvariables are expressed by majority of the relationship managers. The variables are employee willingness, customer’s need identification, training and encouraging employees, adequate service knowledge, key customer priority, use of IT and the latest software, customer relationship status, customer information tracking, interactive customer interface, building long term relationships, product/service customization etc.

It is significant to note, that most of the respondents mentioned the variables related to CRM along with the variables related to the relationship maintenance (RM) factor. From literature and the field study it is obvious, that CRM along with some other factors like relationship maintenance facilitates smooth conduct of relationship effort; which eventually helps in maintaining long lasting relationships with valued customers.

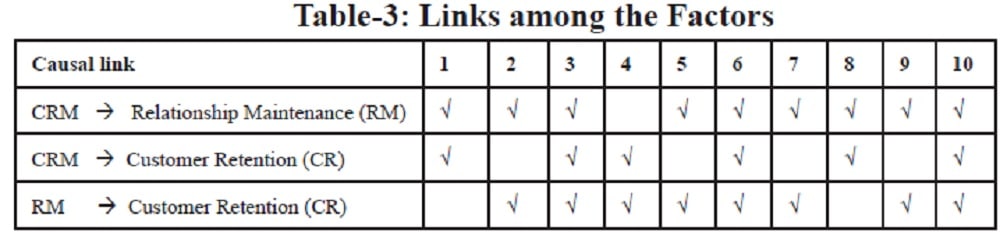

Links among the Factors

Table 3 represents the causal links among the factors. Information related to perceived links evolved during the interviews, and also those extracted from the transcribed interview scripts through content analysis. For instance, the link between customer relationship management and relationship maintenance was identified considering the statement of the interviewee of local Bank 1: “we need to focus on relationship development endeavours. To comply with that, it is essential to emphasize on pre-sales and post-sales communication to determine customer needs. Furthermore, for the highly valued customers we need to attempt to design/redesign the offers/services to match their changing needs, maintaining the guidelines and principles given by the Central Bank.” In a similar fashion, another respondent (R8) opined that, if you (people/bank) want to hold your customer… wants to do good business with him, you need to focus on nurturing the existing relationship”.

It is important to ensure existing customers are retained and encouraged to return stated Lo et al. (2010). Corresponding to this, one respondent (R4) expressed that: “Why people will come to me (bank) repeatedly (to do more business)… only if I can offer him something beyond his expectation, like service excellence, effective communication and follow up … which eventually helps me (bank) to retain him”.

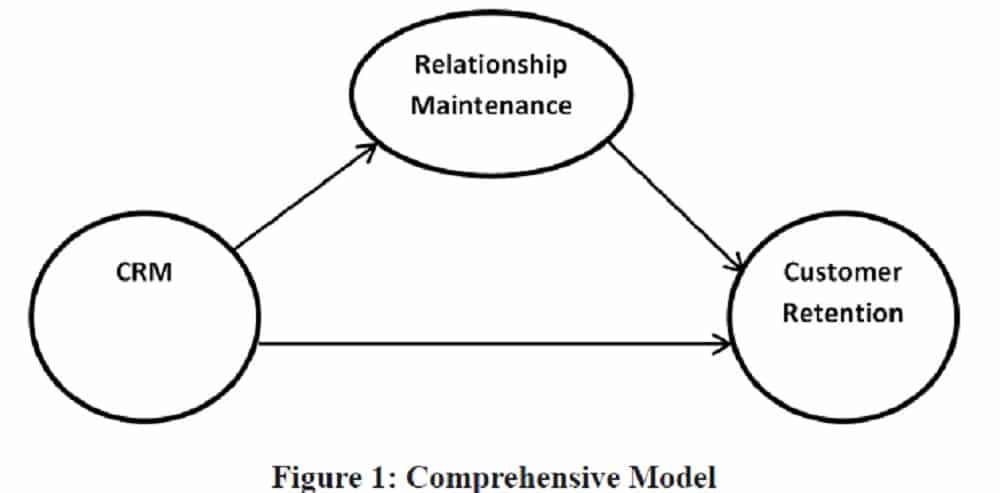

A Comprehensive Model

Figure 1 illustrates a comprehensive CRM model, which has been formed considering a conceptual framework along with the factors and sub-factors identified through the field study (presented in Table 2). Considering the field study outcome, it can be argued that CRM itself has a significant influence on relationship maintenance and also on customer retention. Relationship maintenance also has a significant influence on customer retention.

Research Implications

The model described earlier, is unique as it has been derived and developed using data acquired from the interviews of ten respondents from ten different banks. Based on literature and field study, three hypotheses have been proposed; however not empirically tested. A structural equation modelling approach can be taken, to test the hypotheses and overall fit index of the model.

Managerial Implications

As all the factors and sub-factors have been derived from the field, it can be argued that the proposed model is very close to the target group and adequately reflects issues of CRM. From the model it is also apparent, that each and every factors/ sub-factor eventually leads to bank customer retention. It is expected that this model will be beneficiary to the banking industry of Bangladesh as this model embraces some essential issues like CRM, relationship maintenance and customer retention. It is expected that by implementing this model, banks would be able to know about their customer better than before. This knowledge will also help them to augment and customize their offerings, in line with customer requirements.

Conclusions and Future Study

A qualitative research study approach has been considered, to determine the factors and variables related to CRM implementation. Ten relationship managers of different banks have been interviewed to get an insight about the theme. The selected interviewees are well aware of CRM and CRM related issues. The interview scripts were carefully transcribed by the researchers with adequate caution, and the data were analysed by using a content analysis approach. The data analysis brought out 4 factors and 20 subfactors. Eleven variables were foun to be essential for successful CRM implementation mentioned by majority of the respondents. Those are key customer need identification, customer oriented business process, training and encouraging employees, sufficient and proper customer knowledge, willingness of employees, customer priority, essential use of IT, improvement of friendly interaction, tracking of the status of the relationship, two-way communication etc.

It can be noted, that most of the existing research on CRM is quantitative in nature. This adds to the knowledge of the domain of CRM based on qualitative research. Future research could test the proposed model. The proposed model can be considered as it is, or fine-tuned wherever possible to do an extensive empirical study by the researchers of the CRM arena. Service focused organizations can use those constructs and variables to identify the status of their present CRM practices; which eventually help them in designing and developing effective customer retention strategies focusing on relationship efforts.

REFERENCES

Ahmad, R. and Buttle, F. (2002) Customer Retention Management: A Reflection of Theory and Practice, Marketing Intelligence and Planning, 20:3, pp.149-161.

Barney, J. (1991) Firm Resources and Sustained Competitive Advantage, Journal of Management, 17:1, pp.99-120.

Baxter, L.A. (1990) Dialectical Contradictions in Relationship Development, Journal of Social and Personal Relationships, 7:1, pp.69-88.

Becker, J.U., Greve, G., and Albers, S. (2009) The Impact of Technological and Organizational Implementation of CRM on Customer Acquisition, Maintenance, and Retention, International Journal of Research in Marketing, 26:3, pp.207-215.

Bentum, R.V. and Stone, M. (2005) Customer Relationship Management and The Impact of Corporate Culture – A European Study, Journal of Database Marketing and Customer Strategy Management, 13:1, pp.28-54.

Berg, B.L. (2004) Qualitative Research Methods for the Social Sciences, 5th Edition, Allyn and Bacon, Boston, MA. Campbell, A.J. (2003) Creating Customer Knowledge Competence: Managing Customer Relationship Management Programs Strategically, Industrial Marketing Management, 32:5, pp.375-383.

Chang, W., Park, J.E., and Chaiy, S. (2010) How Does CRM Technology Transform into Organizational Performance? A Mediating Role of Marketing Capability, Journal of Business Research, 63:8, pp.849-855.

Chen, I.J. and Popovich, K. (2003) Understanding Customer Relationship Management (CRM)- People, Process and Technology, Business Process Management Journal, 9:5, pp.672-688.

Cooil, B., Keiningham, T.L., Aksoy, L., and Hsu, M. (2007) A Longitudinal Analysis of Customer Satisfaction and Share of Wallet: Investigating the Moderating Effect of Customer Characteristics, Journal of Marketing, 71:1, pp.67-83.

Cresswell, J.W. (2003) Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. 2nd Edition, Sage Publications.

Eid, R. (2007) Towards a Successful CRM Implementation in Banks: An Integrated Model, The Service Industries Journal, 27:8, pp.1021-1039.

Finnegan, D.J. and Currie, W. (2010) A Multi-layered Approach to CRM Implementation: An Integration Perspective, European Management Journal, 28:2, pp.153-167.

García-Murillo, M. and Annabi, H. (2002) Customer Knowledge Management, Journal of the Operational Research Society, 53:8, pp.875-884.

Gholami, S. and Rahman, M.S. (2012) CRM: A Conceptual Framework of Enablers and Perspectives, Business and Management Research, 1:1, pp.96-104.

Gupta, S. and Zeithaml, V.A. (2006) Customer Metrics and Their Impact on Financial Performance, Marketing Science, 25:6, pp.718-739.

Gustafsson, A., Johnson, M.D., and Roos, I. (2005) The Effects of Customer Satisfaction, Relationship Commitment Dimensions and Triggers on Customer Retention, Journal of Marketing, 69:4, pp.210-218.

Gwinner, K.P., Bitner, M.J., Brown, S.W., and Kumar, A. (2005) Service Customization through Employee Adaptiveness, Journal of Service Research, 8:2, pp.131-148.

Homburg, C., Droll, M., and Totzek, D. (2008) Customer Prioritization: Does It Pay Off, and How Should It Be Implemented?, Journal of Marketing, 72:5, pp.110-130.

Jayachandran, S., Sharma, S., Kaufman, P., and Raman, P. (2005) The Role of Relational Information Processes and Technology Use in Customer Relationship Management, Journal of Marketing, 69:4, pp.177-192.

Krasnikov, A., Jayachandran, S., and Kumar, V. (2009) The Impact of Customer Relationship Management Implementation on Cost and Profit Efficiencies: Evidence from the U.S. Commercial Banking Industry, Journal of Marketing, 73:6, pp.61-76.

Lindgreen, A., Palmer, R., Vanhamme, J., and Wouters, J. (2006) A Relationship-management Assessment Tool: Questioning, Identifying, and Prioritizing Critical Aspects of Customer Relationships, Industrial Marketing Management, 35:1, pp.57-71.

Lo, A.S., Stalcup, L.D., and Lee, A. (2010) Customer Relationship Management for Hotels in Hong Kong, International Journal of Contemporary Hospitality Management, and 22:2, pp.139-159.

McCraken, G. (1988), The Long Interview, 1st Edition, Sage Publications.

Miles, M.B. and Huberman, A.M. (1994) An Expanded Sourcebook: Qualitative Data Analysis, 2nd Edition, Sage Publications.

Montgomery, B.M. (1993) Relationship Maintenance versus Relationship Change: A Dialectical Dilemma, Journal of Social and Personal Relationships, 10:2, pp.205-223.

Narver, J.C. and Slater, S.F. (1990) The Effect of a Market Orientation on Business Profitability, Journal of Marketing, 54:4, pp.20-35.

Palmer, R., Lindgreen, A., and Vanhamme, J. (2005) Relationship Marketing: Schools of Thought and Future Research Directions, Marketing Intelligence and Planning, 23:3, pp.313-330.

Payne, A. and Frow, P. (2005) A Strategic Framework for Customer Relationship Management, Journal of Marketing, 69:4, pp.167-176.

Peppers, D. and Rogers, M. (2011) Managing Customer Relationships: A Strategic Framework, 2nd Edition, John Wiley & Sons, Inc.

Ray, G., Muhanna, W.A., and Barney, J.B. (2005) Information Technology and the Performance of the Customer Service Process: A Resource-based Analysis, MIS Quarterly, 29:4, pp.625-652.

Reimann, M., Schilke, O., and Thomas, J.S. (2010) Toward an Understanding of Industry Commoditization: Its Nature and Role in Evolving Marketing Competition, International Journal of Research in Marketing, 27:2, pp.188-197.

Reinartz, W., Krafft, M., and Hoyer, W.D. (2004) The Customer Relationship Management Process: Its Measurement and Impact on Performance, Journal of Marketing Research, 41:3, pp.293-305.

Roberts, M.L., Liu, R.R., and Hazard, K. (2005) Strategy, Technology and Organisational Alignment: Key Components of CRM Success, The Journal of Database Marketing and Customer Strategy Management, 12:4, pp.315-326.

Robinson, L., Neeley, S.E., and Williamson, K. (2011) Implementing Service Recovery through Customer Relationship Management: Identifying the Antecedents, Journal of Services Marketing, 25:2, pp.90-100.

Ryals, L. (2005) Making Customer Relationship Management Work: The Measurement and Profitable Management of Customer Relationships, The Journal of Marketing, 69:4, pp.252-261.

Strauss, A. and Corbin, J.M. (1998) Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory, 2nd Edition, Sage Publications.

Yim, F.H., Anderson, R.E., and Swaminathan, S. (2005) Customer Relationship Management: Its Dimensions and Effect on Customer Outcomes, Journal of Personal Selling and Sales Management, 24:4, pp.265-280.

Zablah, A.R., Bellenger, D., and Johnston, W.J. (2004) Customer Relationship Management Implementation Gaps, Journal of Personal Selling and Sales Management, 24:4, pp.279-295.

Zikmund, W.G. (2000) Business Research Methods, 6th Edition, Dryden Press, Fort Worth, TX.

Dr. Mohammed Alamgir, Professor, Department of Marketing, University of Chittagong, Chittagong, Bangladesh. E-mail: alamgir92@gmail.com.

Dr. Mohammad Nasir Uddin, Associate Professor, Department of Marketing, University of Chittagong, Chittagong, Bangladesh.

E-mail: nasircuctg@yahoo.com.