Pricing SaaS Models: Perceptions Of Business Service Providers And Clients

The paradigm shift in delivery of software applications from a shrink wrapped / licensed form to a more end- user friendly ‘service’ was fueled by the opportunity that the Small and Medium size Businesses (SMBs) created. It created a way to deliver the existing software applications to new markets or serve existing markets in a new cost effective way. The bottom line being, customers who do not have the expertise or capital budget to purchase, install, and manage applications, can subscribe to hosted services for a recurring fee. This model came as a fresh dose of energy to an otherwise matured model, but brought with it a lot of complexities which a service provider will have to address. Key concerns include pricing of such pay-per-use models. The paper has attempted to address the concerns of the service provider, while pricing such services, by delving deep into their internal perceptions as well as extraneous intended end -user perceptions.

INTRODUCTION

The delivery of software services has come a long way since its initial formative years. For very long software applications were delivered shrink wrapped and purchased by paying a one time license fee. This meant that clients, who want to scale up the usage of the software they bought, paid a high cost for the scale up. It meant that as the number of users increased, clients paid more license fees. On the other hand clients may want to use software when they need to and not all the time. Which meant a whole day’s license or a month’s license will serve as an idle one with money locked in for a client, not providing need based value. It appears that there was a need to have a different definition of usage and price of usage of software applications. In a fiercely value based competitive environment, the one time license has proved a failure for client usage patterns. The emergence of Software as a Service (SaaS) as an alternate solution to the one time license appears to be growing in popularity. Delivering a flexible pay and use model appeared to be a better model. It also posed the challenge of who will mediate between a client and an original software tool manufacturer in hosting and maintaining such a software service to keep up with the changing whims and fancies of a client. If someone else hosts the service, then according to (Cusumano, 2007), this reduces the cost incurred by a customer or client, in installing and maintaining the software tool on their own servers and systems. An additional challenge if a hosting mediator can provide such a service, is how to price the service? Pricing for pay and use needs a different approach than what was used for a one time license. The challenge of pricing such a service is a complicated one. This paper looks at the SaaS model from software service pricing perspectives. It looks at pricing from the perspectives of a mediating service provider, keeping the features of SaaS based software delivery in mind. A perceptive analysis of variables that may influence price is investigated. The mediator in the picture is referred to as the “Business Service Provider”. Perceptions of the business service provider and the “client users” is described.

A look at literature covering this area reveals that authors have discussed pricing issues of software in general. (Bontis and Chung, 2000) argue that pricing software must take a more subjective approach. They say that there is no generalized formula to value the intellectual capital in the software and thus it is difficult to obtain a generalized pricing model for software. They emphasized important approaches like the ‘named user licenses’. They also looked at user classes and user markets in three case studies of Graph On, Nortel and Hire Systems.

Echoing the changing scenario in software delivery, other researchers, emphasize the importance of understanding pricing under these changing scenarios. The warning was that failure to do so will result in a large number of software product companies vanishing and going out of business. According to Cusumano (2007) pricing software in the changing scenario requires creativity in the complexity.

Cusumano (2007) says that, “product companies that have remained in the software business have had to adapt their strategies as well as pricing and delivery models. Product companies can no longer afford to spend enormous sums of money on R&D and marketing to build and sell features that customers do not want or use”. Cusumano describes a labyrinth of creative software pricing models in his paper. But strangely ends the paper with a fond wish that things be easy, quoting research results on data that an MIT student collected, he suggests that “monthly subscription fees with hosting may be the most common future strategy for enterprise software product companies with web versions of their products”.

On the other hand authors have named and focused on describing the new delivery model namely SaaS. They also visualize SaaS as changing the pricing approach used for software delivery today. According to (Herbert, 2007) “key characteristics that distinguish SaaS from alternative deployment approaches include tenancy, pricing model, upgrades, number of contracts required, license ownership” Herbert defines SaaS by saying that “in its most rigid definition SaaS is built from the ground up to be multi-tenant at all layers of the stack: database, server and application. SaaS is typically sold on a subscription or term license basis that includes upgrades, maintenance and some level of support”.

Today SaaS continues to create a buzz in the market. According to CMSWIRE (2009), Gartner defines SaaS, as a “software that is owned, delivered and managed remotely by one or more providers”. CMSWIRE (2009) quotes Gartner to describe SaaS as one which “provides delivery of multi-tenant service, from a remote location, over an internet protocol (IP) network and via a subscription-based outsourcing contract”. CRM today (2009), quotes Gartner to state that the rapidly growing SaaS is about $6.4 billion in 2008 and that the “market is expected to be more than double with SaaS revenue reaching $14.8 billion in 2012”. “Software as a Service” (SaaS) industry is in the midst of a five-year period of 43 per cent average annual compound growth, and is expected to own a 23 per cent share of the $120 billion U.S. software market by 2010, according to a report by RBC Capital Markets. Putting it simply, SaaS involves bringing the software product to a client in a more flexible and cost effective manner. Hence if the software manufacturer must provide the software to a client directly in a flexible manner, it introduces new skills for a software manufacturer. However, these new skills of need based delivering, hosting and maintaining software is not the core competence of the software developer, and thus the third player comes into focus, namely the one that plays the mediator. This new way of approaching the problem of software delivery using the SaaS mode thus brings three new actors together in a collaborative manner.

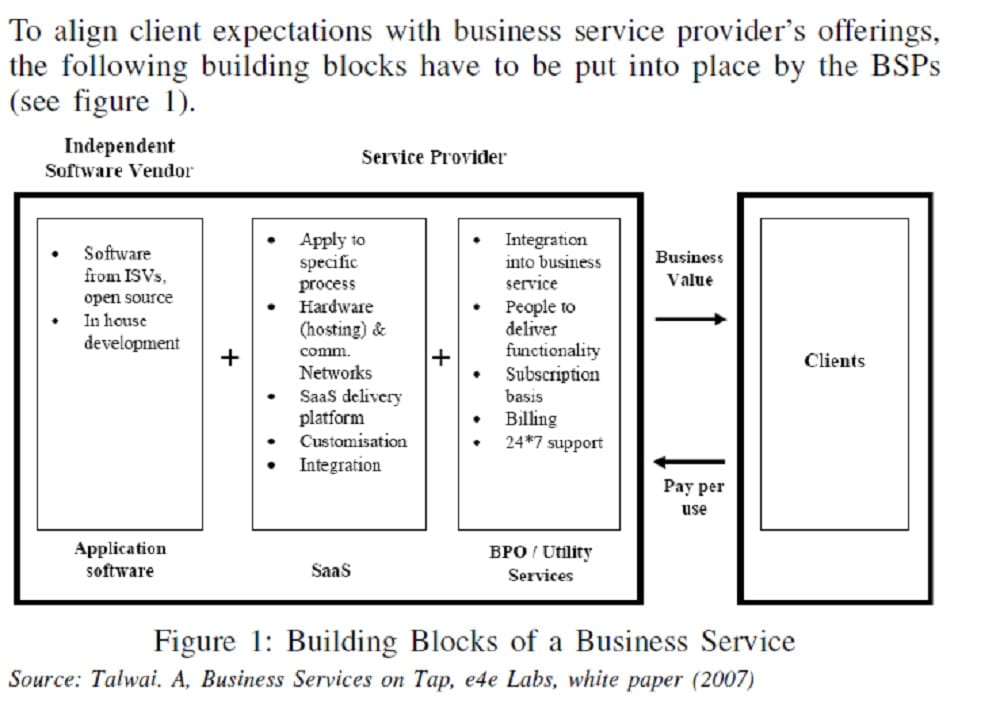

These actors are the:

l

- Independent Software Vendor (ISV) – software manufacturer or developer, or owner of the software product, tool or application and a end user client would want.

- Business Service Provider / Service Provider (BSP) – one who adds value to the software provided by ISV’s by converting the opportunity into a business service. These BSPs act as mediators between the software manufacturer/developer and the client and they host the software in their servers and infrastructure for clients to access from their remote location. Thus the core competence of the BSP is to host, deliver, maintain and customize the software (with the help of the ISV) for the client. This includes understanding of business processes of clients, customizing their needs, integrating the software with the clients existing systems and hardware, networking and support related matters, upgrading the software without hassling the client for it. Typically, BSP gets into an agreement with an ISV to provide the software product/application to the client.

- Client – one who utilizes the business service provided by the BSP and pays as per usage. Thus, a client need not buy or license out the software from the ISV but has a more flexible usage based payment arrangement with the BSP.

The joint business of these three actors leads to a new way of delivery of software to enterprises namely the “Business Services”. Business services help enterprises capture the value of software and their business functions. Business services are built on the characteristics of SaaS namely, pay per use, ease of use and lowered Total Cost of Ownership (TCO).

An effective business service is one which delivers business value to the clients. Hence defining a Business service rom a clients’ perspective becomes important. The focus should therefore be on what the client expects from the business service provider. Outlined below are some such expectations:

- Customization to needs

- Minimal Total Cost of Ownership (TCO)

- Easy integration with business functions

- Ease of use with minimal training

l Efficient service and support - Scalability

- Flexibility in usage and options

In short, the client expects to focus on his or her core competency, and leave all his or her software woes to the business service provider to take care off.

On the other hand, the Business Service Providers’ (BSP) focus would be on client requirements, with emphasis on meeting the following characteristics:

- Mapping functional requirements (initial services will be those which focus on business side of client organization)

- Minimal customization

- Internet / web delivery requirements

- Ease of ramp up / ramp down of usage options

- Minimal implementation time

- Flexible subscription options

- Revenue generation through subscription fees (per month, per user, pay per use etc)

- Total Cost of Ownership minimization through multi-tenancy features etc.

- Provide adequate support, upgrade and backup options To align client expectations with business service provider’s offerings, the following building blocks have to be put into place by the BSPs (see figure 1).

COST DRIVERS IN A SAAS MODEL

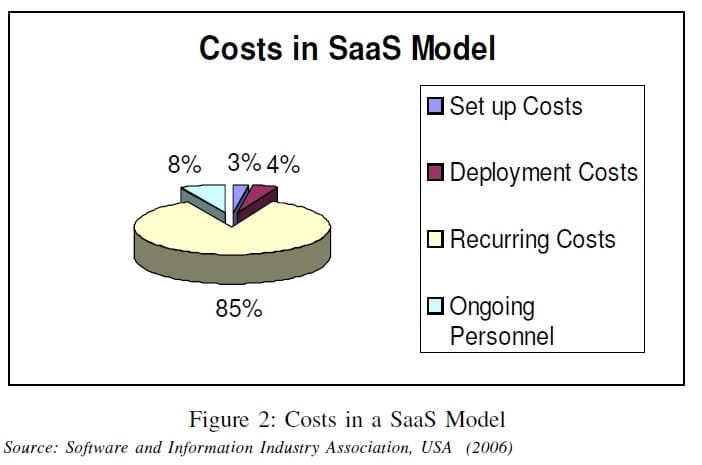

Cost is a recurring feature. Periodical annual fee, internet fee, initial customization costs, infrastructure costs are some costs that a business service provider will face. The service fee will typically include maintenance, support, training and upgrades, storage and database administration.

The above pie chart (see Figure 2) gives the approximate expenditure involved in a typical enterprise. These vary with requirements and from a case to case basis, but the figure gives an idea of the split up of the cost. Some of the calculations indicate that the TCO of a SaaS model is almost 60% less than traditional software delivery model, say for a three year period. This is also a good indicator of the costs savings a client can achieve, though the actual numbers vary with situation.

According to (Bontis and Chung, 2000), vendors must not only understand the value they provide to their customers and create a price structure that aligns pricing with value realization, but more importantly facilitates their business objectives of the product (and service).

This new model of SaaS has brought on complexities that the traditional shrink wrapped software model did not have. Pricing service innovations for such services assume importance because the variables that affects pricing in this model are different from the traditional model. Also, the fact that this model is still at a nascent stage enforces the need for a study on the different variables that go into pricing such services. There is a need to study pricing from two perspectives, that of the Business Service Provider and that of the Client. What are the variables that the Business Service Provider perceives to be important while deciding the price at which he or she will sell the software as a service to a client?

In order to understand pricing of such a service, it is important to know the variables that affect the price as perceived by the clients. The client perspective will help understand the pricing in a better fashion. What are the variables that the client perceives to be important while deciding on the price he/she is willing to pay for software provided by the business service provider as a service?

METHOD

With the objective of understanding how business service providers and clients perceive price variables for SaaS models of software delivery, the survey research design was adopted. Although pricing estimation is a complicated area of research, we attempted this study with the assumption that the view that these two actors had about pricing will provide insights to understand pricing dynamics in SaaS. The variables identified, their measurement design, the sample from whom data was collected and the analysis plan is described below.

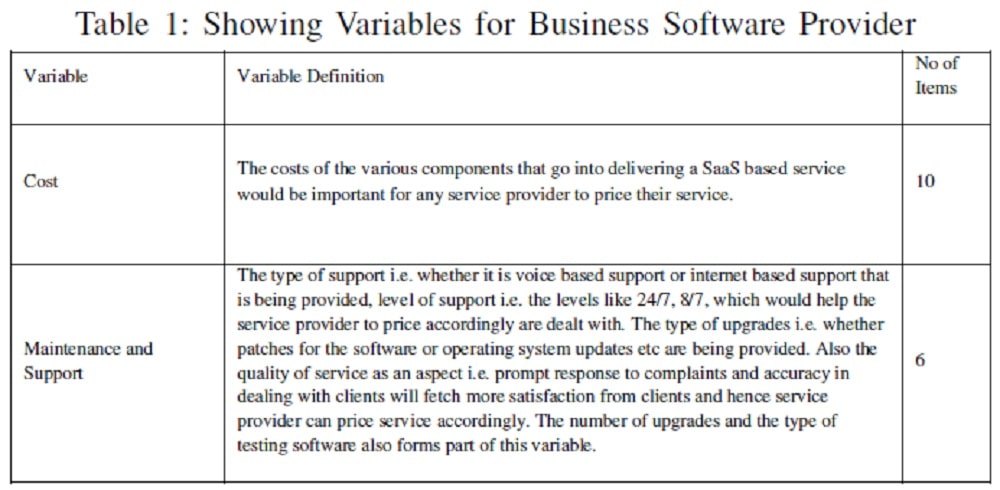

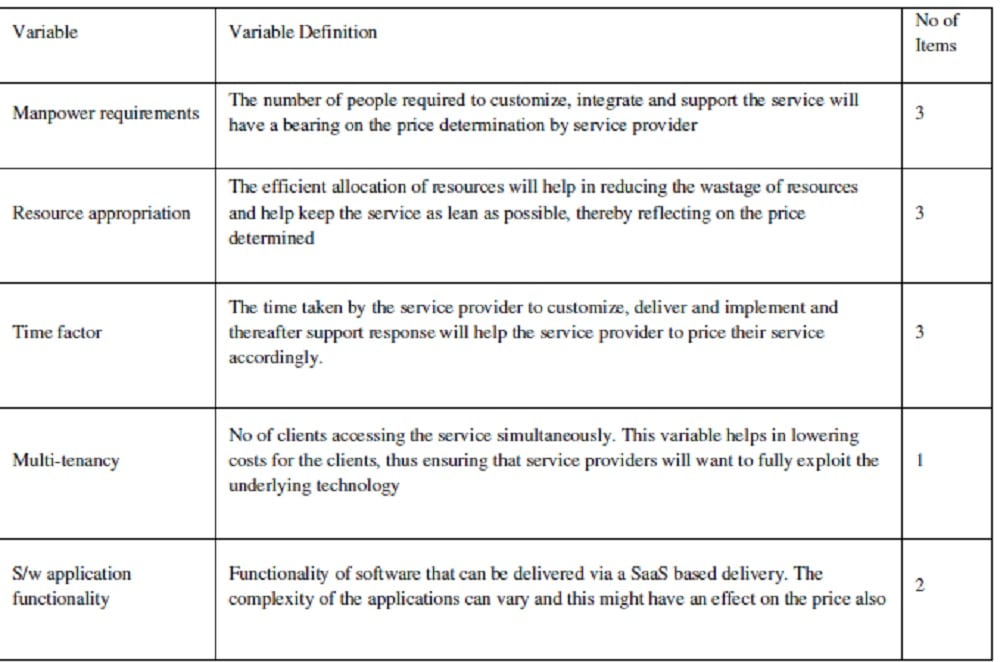

Variables: Different sets of variables that may have potential to influence price were identified for the two actors, namely business service providers of and clients using SaaS. The variables used for the sample of business service providers are first discussed.

Variables, used to assess the perceptions of business service providers, covered characteristics of SaaS based delivery and these variables are described in Table 1. A total of seven variables were identified and these were expected to have a high influence on price. They were cost, maintenance and support, manpower requirement, resource appropriation, time factor, multi-tenancy and software application functionality.

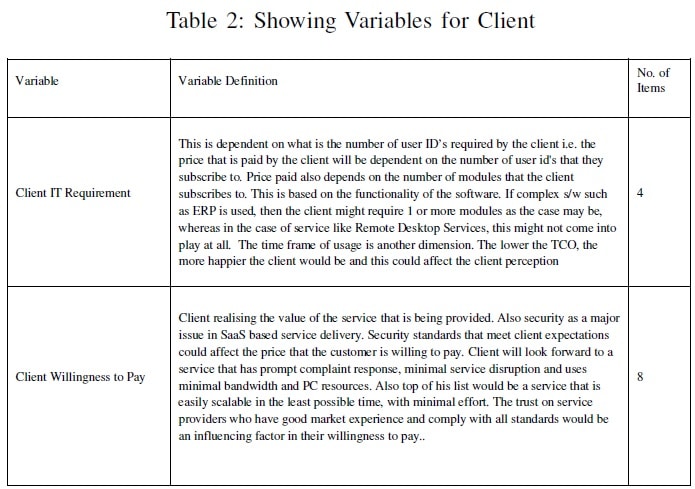

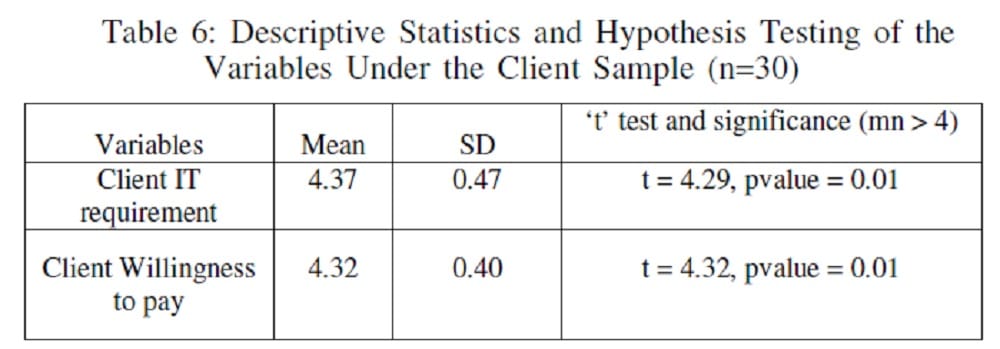

Variables related to how a client will perceive the price of SaaS based delivery were two, namely, clients’ IT requirements and clients’ willingness to pay. These are described in Table 2.

Since price per se cannot be measured when using this research design, samples were made aware that the variables are being rated as influencers of price for SaaS based software delivery and thus, the sample responded with this mental paradigm.

Measurement: Since the perceptions of the two actors were being solicited, the Likert type 5 point rating scale was deemed suitable for the measurement of the above variables. As always known, the Likert type rating scales are suitable for variables that do not have a ready scale to measure them. The questions for both business service provider and client using SaaS followed the same measurement design. Items were developed to measure each variable. Items were measured on a five point Likert type rating scale ranging from extremely important (5) to extremely unimportant (1). The number of items designed for each variable is reported in Tables 1 and 2. The questionnaire was subjected to an experts view and feedback obtained was satisfactory. This meant that the items were clear, having face validity and valid for the sample of business service provider providing and clients using SaaS. The questionnaire is available in Appendix 1, and available for those interested in future research using it.?

Accordingly, seven hypotheses were arrived at for the business service provider providing SaaS and 2 hypotheses for the clients using SaaS. The assumption was that these variables, derived from literature and discussion with experts, will have a bearing on the price of SaaS based software delivery. Hence we expected a reasonably high mean rating for each item. The following general hypotheses were stated:

HBSPmean = Expected mean rating > 4 for variables, cost, maintenance and support, manpower requirement, resource appropriation, time factor, multi-tenancy and software application functionality, in relation to pricing.

HCmean= Expected mean rating > 4 for variables, client IT requirements and client’s willingness to pay, in relation to pricing.

Since these variables are expected to have a high relationship to the price of SaaS based software delivery it was assumed that between the variables there must be a high correlation behavior. The following general hypotheses on their relationships were also verified.

HBSPcorrel = Expected r value is significant for inter-variable correlations for variables, cost, maintenance and support, manpower requirement, resource appropriation, time factor, multi-tenancy and software application functionality, in relation to pricing.

HCcorrel = Expected r value is significant for inter-variable correlations for variables, client IT requirements and client’s willingness to pay, in relation to pricing.

Reliability concerns the extent to which measurements, are repeatable and consistent when repeated, are stable over a variety of conditions. The reliability coefficient used to assess the reliability of the items was the Cronbach’s Alpha (a). For the business service provider questionnaire, the results show that 2 variables have an alpha that is above 0.70, and 5 variables have an alpha that is less than 0.70. Overall the a was 0.84. For client questionnaire, overall the a was 0.57. This alpha is on the lower side and mild inconsistency appears to be present in this questionnaire. However, since this is an initial attempt in this area, the possibility of future improvements in the reliability figures is high with larger samples and repeat samples.

Sample: As the study was conducted in an emerging area, the number of organizations already providing this service or keen on such services were relatively difficult to find. However, some of the major Indian and multinational IT and Telecom organizations already followed the SaaS model. These business service providers were mostly services or product companies. The middle/senior level management was selected for data collection. This included heads of SaaS based business units, operations/program managers in IT and telecom services organizations, developers and technical leads in IT and telecom products based organizations, technology and process consultants from some of the major consulting organizations in IT, general management areas as well as experts from academia.

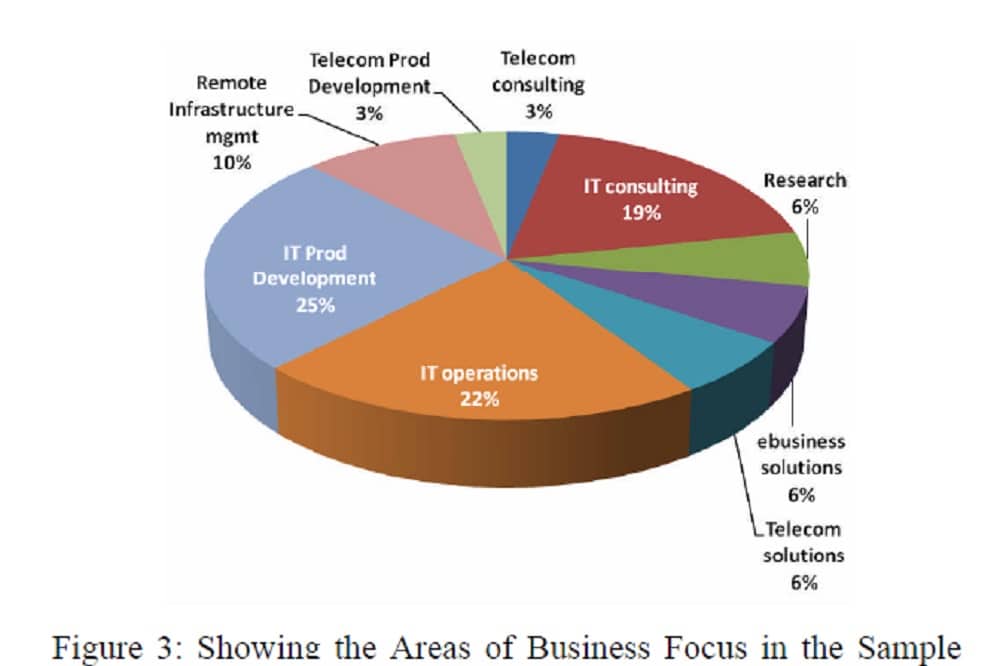

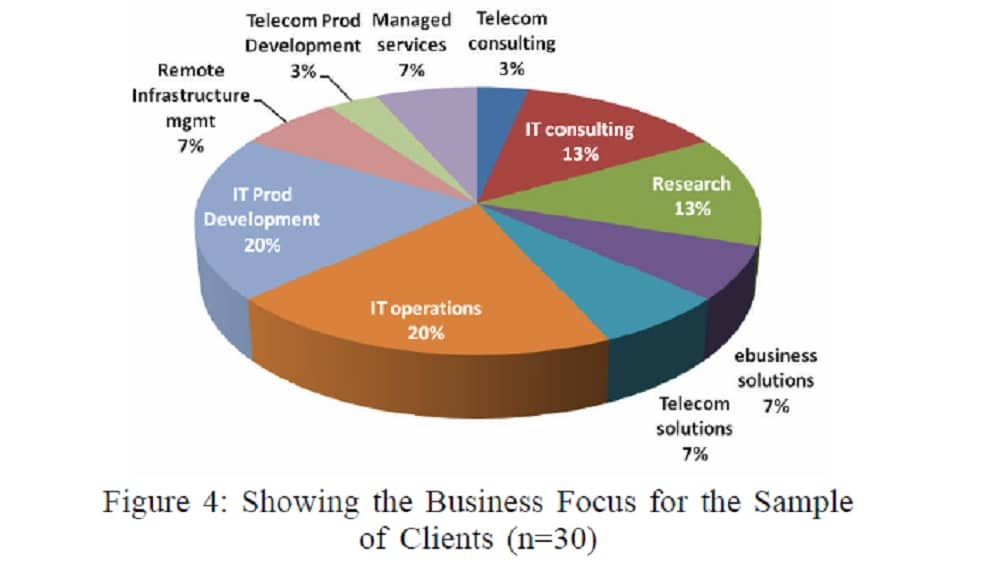

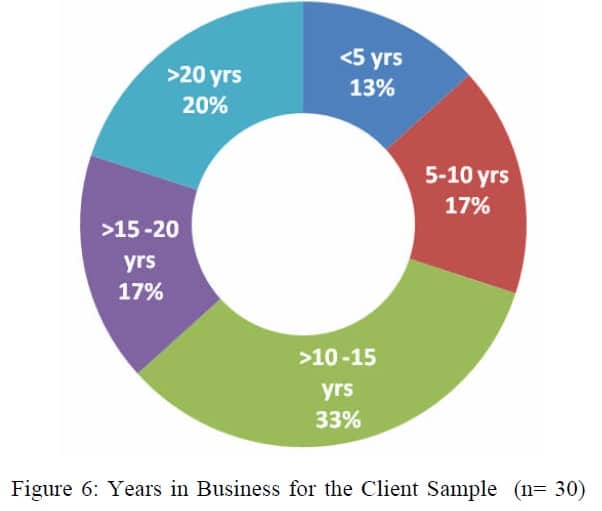

For the client sample, respondents were from organizations using software applications, not restricted to IT/ Telecom alone, but also clients availing of software delivery in verticals of infrastructure, financial and energy. The sample is described below in Figures 3 to 6. Figure 3 shows the sectors from where the samples were picked. It shows that IT operations and product development sectors were predominant for the business service provider. Figure 4 shows a similar picture for clients with moderate variations in percentages. Clients appear to do more R&D than the business service providers.

Business Service Providers (n= 32)

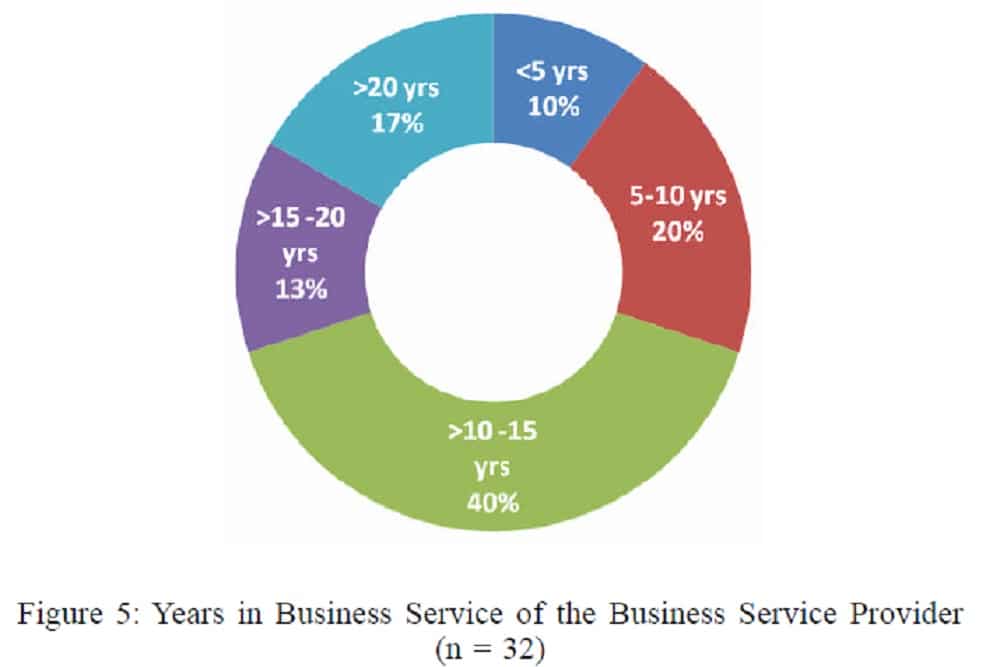

Figure 5 shows the experience of the business service provider, showing about 10-15 years of experience to be a dominant characteristic of this sample. Although the client sample also shows a dominance of the same amount of years of experience, they are a little less in experience compared to the business service provider.

The years of experience are also a reflection of the age of the IT industry in India.

The random sample, of business service providers providing and clients using SaaS, was administered the questionnaire and data was collected using two methods, namely web based data collection and through a personalized face to face administration of the questionnaire.

RESULTS

The results focus on two aspects. First, on the service providers perception of what determines price in a SaaS model, and second, the client’s perception of price in the context of SaaS based service model of software delivery.

RELATIONSHIP ANALYSIS OF VARIABLES INFLUENCING PRICE

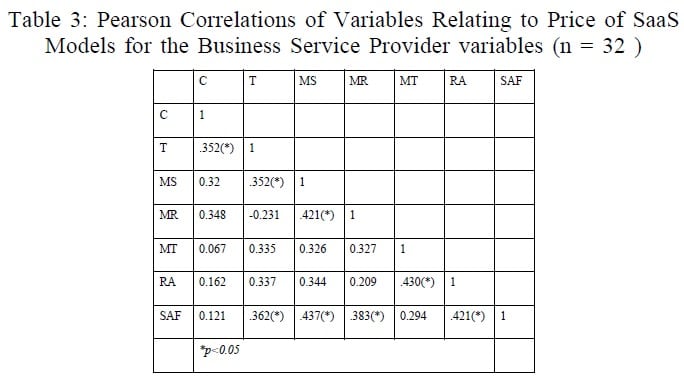

Pricing theory is a well researched area, however identifying variables to estimate it remain a challenge. Since SaaS models are relatively new in India, pricing for SaaS and the actual variables influencing price, are yet to be ascertained and described. The results described here is an attempt in that direction. The relationship between the selected variables is determined to verify if they are similar and having commonalities in them. Being correlated will imply that they may have a joint effect on price as seen by the business service providers. If seen as uncorrelated then, such variables may have independent influences on price. Pearson correlations computed for all variables, cost (C), time factor (T), maintenance and support (MS), manpower requirements (MR), multi-tenancy (MT), resource appropriation (RA) and software application functionality (SAF) are shown in Table 3.

Most variables showed no significant inter variable correlations. This implies that the chosen variables can have an independent influence on price, except for software application functionality, which showed correlations with most other variables. Significant correlations in Table 3 show that software application functionality is positively correlated with time factor, maintenance and support, manpower requirements and resource appropriation. Software application functionality implies that more the functionalities, more the cost of the SaaS based service. The relationship between time factor and application functionality shows that time to customize and deliver the software will increase if functionalities are more complex and thus a possibility that price too will go up. The same goes with maintenance and support, which can increase with the extent of software application functionalities increasing and possibly pricing also increasing. So is the case with cost of manpower also. Manpower costs will increase given an increase in the number of software application functionalities.

The variable of time factor additionally had significant relationships with maintenance and service and also cost. This clearly shows that the respondents’ perceptions support the underlying relationship that if maintenance and services goes up then time factor goes up and so does the cost to the business service provider and the client. It is also seen that as multi-tenancy increases, resource allocation increases and this is a valid relationship.

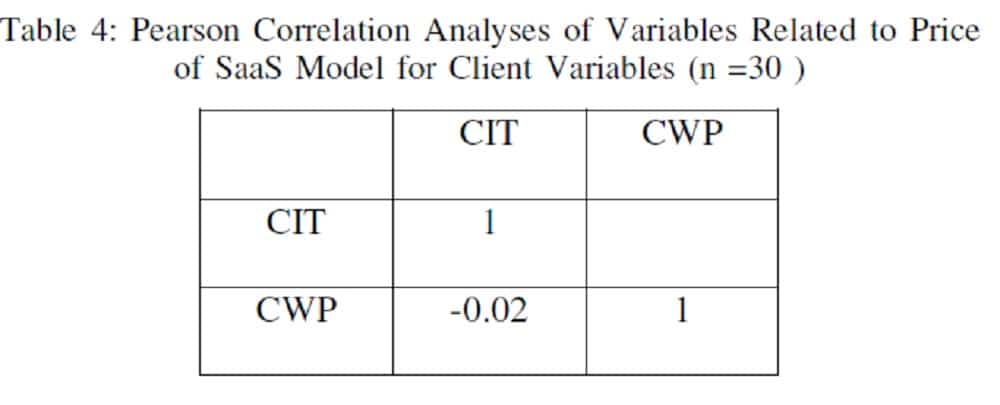

Looking at the way clients perceive correlations in their variables, it is seen from Table 4, that clients show a low correlation (insignificant) between client IT requirements and client’s willingness to pay. This implies that something else determines client’s willingness to pay. Although these two variables should have had high correlation they surprisingly appear not to have any relationship. Whilst this finding would be against normal price theory, in this case it can be argued that greater the Client IT requirement, the lesser the client is willing to pay. It is possible that, as had been suspected all along, the trust levels of the client on the quality of service and security of confidential data, confidence on scalability and ease of use etc., goes down as the requirements go up. The clients may rather stick on to the traditional mode of delivery rather than the SaaS model until trust is established, as can be understood from the findings. They do not perceive the value of this service accordingly, and this implies that business service providers need to educate and instill confidence in the minds of the clients, who are worried about the long term sustainability as also the peace of mind factor (security and confidentiality of data) in the SaaS model, as against a traditional licensing model. Thus, clients are not willing to pay more even if they have more IT requirements.

PERCEPTIONAL ANALYSIS OF VARIABLES INFLUENCING PRICE

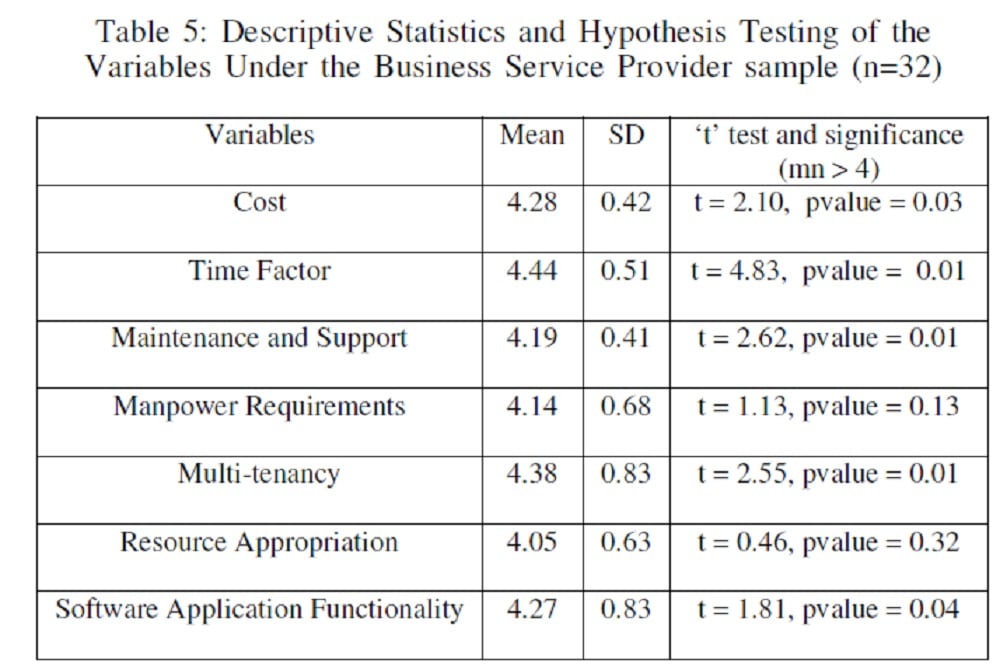

The significance of the selected variables on price as perceived by the business service providers and clients is now assessed using univariate descriptive analysis. Table 5 and 6 shows the mean ratings. Further, in order to understand how important the variables were for business service providers and clients, we understood how significant these variables were for them. As the responses from the sample are on a Likert scale, which is on a scale of 1 to 5, we can safely assume that the responses of 4 and 5 are important. Hence if we were to find that the entire population is to give that response, then the variable has a good significance in explaining the business service provider or client determined price.

This was done using the t-test for hypothesis. The population mean was verified to be greater than 4 or not, as 4 is almost 75th percentile in the scale. A rating of 4 on the Likert scale is defined as “important” on the scale anchor. Taking each of the variables and performing a one sample hypothesis testing using a one tailed t-test, this importance is verified. Here the assumption is that all the variables satisfy the condition of normality. The analysis is done using the Linux based free software for statistical analysis called, R software.

Table 5 shows the mean ratings for the business service provider. The highest mean recorded was for time factor followed by multi-tenancy. Showing that as time and tenants go up the business service provider sees a clear relationship of the price also going up (refer also to Table 3). Interestingly the lowest mean was recorded for manpower requirements. Business service providers did not see manpower requirements as very important to determine price. Looking at the statistical t tests conducted on the variables, it is seen that 5 out of the 7 variables used in this study for business service providers showed statistically significant mean ratings. The variables are cost, time factor, maintenance and support, multi-tenancy and software application functionality. These appear to be quite significant in understanding the business service providers’ determination of price.

Table 6 shows the mean rating and t test conducted on the client based variables. Interestingly both variables show a significant t test value. Hence while a relationship between these two variables was absent (Table 4), the clients do see both variables as important in determining the price of SaaS based software delivery.

CONCLUSION

It is clear that business service providers and clients see pricing for SaaS based software delivery in different perspectives. A literature review and interactions with experts gave us seven variables to be considered for the business service provider and two for the client. These variables were expected to have an influence on pricing SaaS based software delivery. From the relational analysis we noticed that software application functionality has a positive correlation with many variables like time factor, maintenance and support, manpower requirements and resource appropriation. This implies that as the said software that is being distributed via SaaS gets more complex, with functionalities, this also increases the time factor of delivery, maintenance and support, manpower requirements and resource appropriations. Hence if functionality gets complex, then these correlated variables will also go up in cost, thus increasing the cost to the business service provider and the final price to the client.

Strangely the relational analysis showed that clients do not see a relationship between IT requirements and willingness to pay for the SaaS based services. It appears that awareness sessions and training of clients on SaaS based services and their implications is essential in order for the client to see value and thus, pay for the service. The poor value that one time licenses bring is something that clients must be made aware of.

From the perceptional analysis it is clear that the variables considered in the study were appropriate when studying price of SaaS based models. Most of the variables considered for the business service provider and both of the client variables showed a significantly high rating. Future research can look at other variables in the context of determining price.

REFERENCES

Bontis, N., Chung, H. (2000) ‘The Evolution of Software Pricing: from box licenses to application service provider models’, Internet Research: Electronic networking applications and policy, 10:3, 246-255.

Bontis, N., Dragonetti, N., Jacobsen, K. and Roos, G. (1999) ‘The knowledge toolbox: A review of the tools available to measure and manage intangible resource’, European Management Journal, 17:4, 391-402.

Cusumano, M. (2007) ‘The Changing Labyrinth of Software Pricing’, Communications of the ACM, 50:7, 19-22.

Davidson, A. and Simonetto, M. (2005) ‘Pricing strategy and execution: An overlooked way to increase revenues and profits’, Strategy and Leadership, 33:6, 25-33.

Ferrante, D. (2006) ‘Software Licensing Models: What’s out there?’, IT Professional, 8:6, 24 -29.

Herbert, L., Dent, A. (2007) ‘When Software-as-a-Service Makes Sense’, Supply & Demand Chain Executive, February 1.

http://www.cmswire.com/cms/enterprise-cms/gartner-saas-is-hot-revenue-will-keep-rising-

003397.php (accessed on March 2009)

http://www.crm2day.com/content/t6_librarynews_1.php?news_id=125472 (accessed on March 2009)

http://www.siia.net/index.php?option=com_docman&task=search_form&Itemid=59 (accessed on December 2008)

Kannan, P.K., Kopalle, P.K. (2001) ‘Dynamic Pricing on the internet: Importance and implications for consumer behaviour’, International Journal of Electronic Commerce, 5:3, 63-83.

Nair, S., Kasturi, S. (2007) Business services based on Software as a Service, Internship Report, Bangalore, e4e Labs.

Narahari, Y., Raju, C.V.L., Ravikumar, K., Shah, S. (2005) ‘Dynamic pricing models for electronic business’, Sadhana, 30:2&3, 231-256.

South, S. (1981) ‘Competitive advantage: the cornerstone of strategic thinking’, Journal of Business Strategy, l:1, Spring, 15-25.

Talluri, K.T. and van Ryzin, G.J., (2004) The Theory and Practice of Revenue Management, Boston,MA, Kluwer Academic Publishers.

Talwai, A. (2007) Business Services on Tap, White paper, Bangalore, e4e Labs.

Mary Mathew, Associate Professor, Department of Management

Studies, Indian Institute of Science Bangalore, India.

Sumesh Nair, Graduate Student, Department of Management Studies

Indian Institute of Science Bangalore, India.