Risk Management In Software Outsourcing-A Portfolio Analysis Of India’s Case Based On Software Export Market Constitution

India, famous for its software outsourcing service, has achieved high growth rates in software exports in recent ten years. The figure of Indian software export destination shows that the US has been the dominant destination for more than a decade. The US is overall India’s largest customer in this sense. In other words, Indian software export is heavily dependent on the US market. Risks exist in software outsourcing market not only for outsourcers but also for software outsourcing service vendors. Thus, risk awareness and risk avoidance, in a word, risk management is undoubtedly very crucial for the sustainable development of software industry. From the perspective of risk management, this paper provides to give some suggestions for software outsourcing service vendors by means of the portfolio analysis of India’s software export market constitution. Though it is a simple two-market portfolio analysis model, the implications are significant for raising outsourcing service vendors’ awareness in risk management, future market strategy and industrial development.

INTRODUCTION

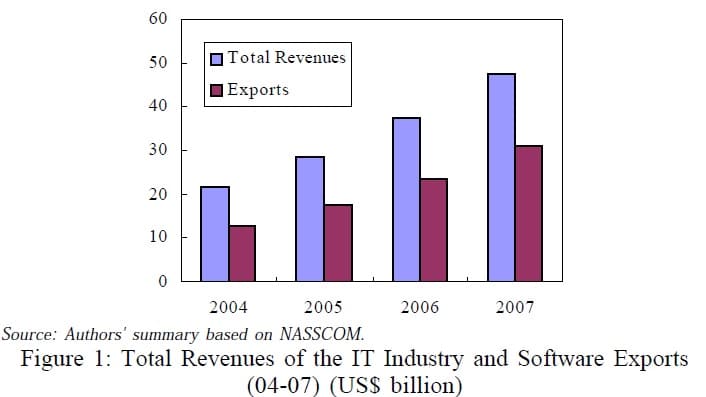

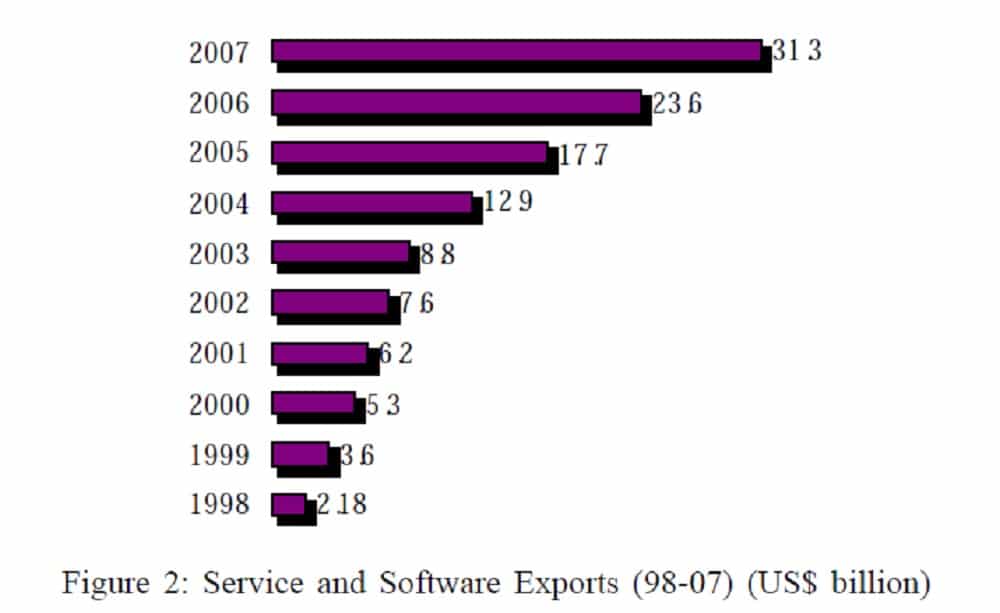

The success story of Indian information technology (IT) industry and IT-related service industry is now acknowledged well. Majority of the success in the sector can be attributed to the conspicuous growth and achievement in software exports. India’s leader role in providing software outsourcing service has been gaining increasing appreciation. According to a report from National Association of Software and Service Company (NASSCOM, 2007), service and software exports remain the biggest contributor with 31.3 billion US$ to the total revenue of IT industry as 47.8 billion US $ in 2007. India, famous for its software outsourcing service, has exactly achieved high growth rates in software exports for many years. In order to give a comparison, total revenues of the IT industry and software exports in the last four years are demonstrated in Figure 1. Then, the service and software exports over the last decade are demonstrated in Figure 2.

It is obvious that India’s exports in software and service have increased rapidly. With contribution to over 50 percent of India’s total IT industry’s revenues, they have been playing a crucial role for the development of India’s IT industry. India’s competitiveness in exports of software and outsourcing service has drawn the keen interest for many researches leading to intensive discussions. In research about location attractiveness index on making offshore decisions (A.T. Kearney, 2004), the factors making countries attractive as potential locations for outsourcing were compared and India remains the top player in 25 countries with the highest score in “People skills and availability” which was evaluated from cumulative business process experience and skills, labor force availability, education and language and attrition rates. It is no doubt that important factors like lower cost, good quality, and abundant human resources with excellent IT skill and fluent English communication ability have become the general attractiveness of India when it comes to outsourcing to India.

The beginning of developing IT industry and the achievement were not a sudden decision and a surprising result. Since the 1990s, with its liberalization and deregulation, India has made significant progress in its economic growth. To promote the activities of IT industry and increase IT adoption has been an important national policy for India to compete in the global economy. Software, as a decisive sector in IT, its importance with the ubiquitous characteristics as rapid diffusion and application has been recognized all over the world. Thus, the Indian software industry as a successful example under its economic reforms, has attracted the world attention. Software outsourcing has been the key trump card for total exports and revenues of the Indian IT industry. To most extent, its conspicuous growth in software outsourcing has been with the synergy effect of the progress of the American IT revolution, as the US is the main export destination for India (Sakakibara, 2001).

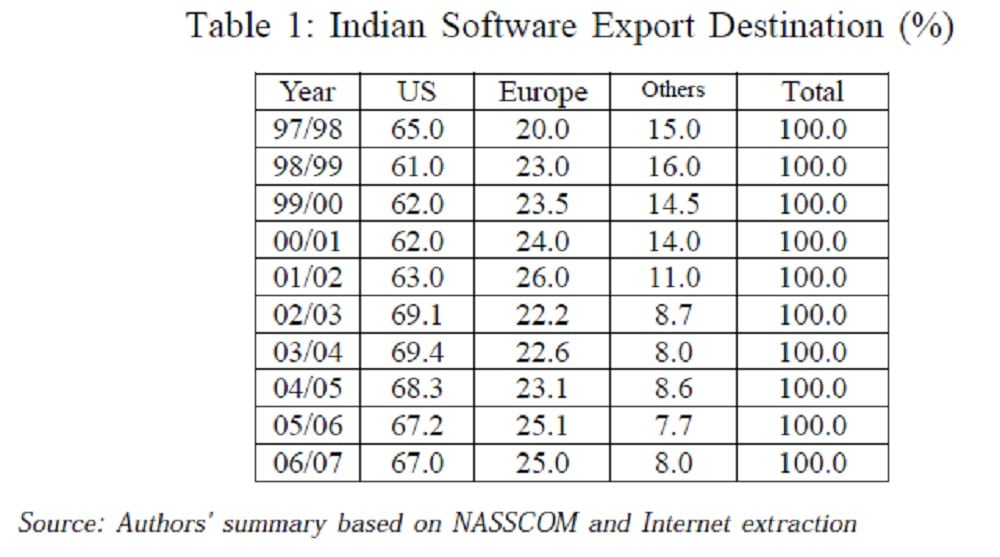

It seems not so interesting to summarize that India’s software outsourcing services are mainly exported to the US, which is now a common sense. Table 1 demonstrates that the US has been the dominant destination for India over the last decade.

Table 1: Indian Software Export Destination (%)

The US is overall India’s largest customer in this sense. In other words, Indian software export is heavily dependent on the US market. In the US, outsourcing to India has been a controversial issue and discussed for a long time. Supporters and opponents seem to have suitable reasons in cost benefits or job reductions, which they believe are directly related to outsourcing decisions. Since risk is inherent to almost any business decision (Aubert et al., 2001), risks exist in outsourcing in particular in case that it involves different geographical and political boundaries. When they discuss outsourcing to India is right or not, the danger from the US market occurs and profits from the US market will change simultaneously, which would finally impact on the sustainable development of the Indian software industry. Compared with the conspicuous growth in export, the development status of Indian software industry in domestic market is not so optimistic. This is related to not only the market demand but also to the belief and confidence of IT vendors in the domestic market. As summarized in NASSCOM’s report, “there was a strong perception among a majority of the CIOs that domestic customers were not a focus area for IT service providers. The CIOs also strongly believe that the potential of the domestic market is still not appreciated by many of the IT services players” (NASSCOM). All these will aggravate the risk exposure that India’s IT vendors face and finally lead to a vicious cycle between profits, industrial development and economic growth.

However, this does not mean that outsourcing itself is not a right move and then should be avoided. (Aubert et al., 2001) reviewed that “It only means that, as in other risky business, risk assessment and risk management are important contributors to the success of an IT outsourcing venture”. These words clearly imply that risk management is indispensable for the success in an IT outsourcing venture for outsourcers or decision makers. However, we should be aware that risks in outsourcing market are not only for outsourcers but also for outsourcing service vendors. When we consider outsourcing decisions as a risky business action, we should realize that it means that risks are equal both for outsourcers and vendors.

In fact, the second export destination known as Europe shows great potential for India to explore. The most important one is that India can still take the advantage of its good language skill in the European market. Otherwise, some emerging Eastern European countries like the Czech Republic, Poland and Hungary will occupy the whole European market in the near future, since these countries are attracting more interest in Eastern Europe from Europe for the geographical closeness to outsourcing. In the same research about location attractiveness index on making offshore decisions (A.T. Kearney, 2004), the Czech Republic ranked 4th, Poland ranked 10th, and Hungary ranked 11th, which showed comparatively good scores in 25 examined countries. If` the language was the obstacle for India to tap other new markets, India should at least balance its export share to the US with Europe by exploring the vast European marketplace and improve its market share in Europe.

Based on the foregoing observations, what should outsourcing service vendors do to avoid risks? What is the well-balanced market constitution for outsourcing service vendors like India? With India’s case, utilizing the portfolio analysis theory, the risks, the expected return and the optimal export market constitution are analyzed. Discussions about risk management for outsourcing service vendors can provide significant insights into the sustainable and healthy development of the software industry both for India and other developing countries.

LITERATURE REVIEW

Outsourcing Risks

Outsourcing risks are factually nothing new. (Aubert et al., 2001) reviewed that “While it can lead to lower costs, economies of scale, access to specialized resources, and new business ventures (Huff, 1991; Gupta, 1992), outsourcing can have unwanted outcomes such as escalating costs, diminishing service levels, and loss of expertise, to name a few (Gack 1994; Earl 1996; Hirschheim 2000). The literature discusses three types of risks as operational risks, strategic risks and composite risks are reviewed. Researches on outsourcing risks can be summarized into various aspects including managerial factors, technical factors and some issues about data security or data privacy. In managerial part, with more firms outsourcing their software/project development or back-up service, issues associated with outsourcing management have attracted a lot of research attention. Trust is also one of the well-discussed issues in software outsourcing. Since trust is considered to be very fragile in outsourcing relationships (Oza, 2006), risks behind the trust maintenance cannot be neglected. Except trust, as (2004) said, “While there are several sources of risk in outsourced development, a major factor leading to dissatisfaction occurs when the technical team and the business client do not share a clear vision of the product and communicate that vision to the development vendor. Furthermore, the resulting disappointment leads to expensive rework, cost overruns and schedule delays”. Here, a clear communication becomes the key in outsourcing risk management; otherwise the project will be at risk of failure. Data security/privacy is another concern in software outsourcing. Though clients are very sensitive to data security/privacy, the potential for risk is still high. Some incidents related to data security in software outsourcing were also mentioned (Reining in Outsourcing Risk). In general, the top 10 risks of outsourcing were computed as cost-reduction expectations, data security/protection, process discipline, loss of business knowledge, vendor failure to deliver, scope creep, government oversight/regulation, culture, turnover of key personnel and knowledge transfer (Davison, 2004).

Although so many researches on risk issues in outsourcing have been conducted, there are few researches on risks from the perspective of software outsourcing vendors. In particular, discussions about risk issues in outsourcing market constitution have been neglected. It is no doubt that risks exist in software outsourcing not only for outsourcers but also for software outsourcing vendors.

PORTFOLIO ANALYSIS

Portfolio Theory

In 1952, Harry Markowitz introduced Portfolio Theory (PT) in his paper “Portfolio Selection”(Markowitz, 1952). He shared a Nobel Prize with two other scholars for this theory in 1990, since it has been an important theory in finance and has been broadly applied in many other fields.

In the paper “Porfolio Selection”, Markowitz said that “We next consider the rule that the investor does (or should) consider expected return a desirable thing and variance of return an undesirable thing. The portfolio with maximum expected return is not necessarily the one with minimum variance. There is a rate at which the investor can gain expected return by taking on variance, or reduce variance by giving up expected return” (Markowitz, 1952). Here, the variance of return is usually regarded as the risk’s proxy in mathematical computation. Risk and return are the basic concepts of PT. Then, in financial management, given two assets that imply the same expected return, investors will prefer the less risky one with smaller variance of return. Markowitz also gave another key word as “diversify” in his paper (Markowitz, 1952). He said that “There is a rule which implies both that the investor should diversify and that he should maximize expected return” (Markowitz, 1952). It is writen that “Modern porfolio theory (MPT) proposes how rational investors will use diversification to optimize their portfolio and how a risky asset should be priced”. Now when it refers to PT, it usually means MPT.

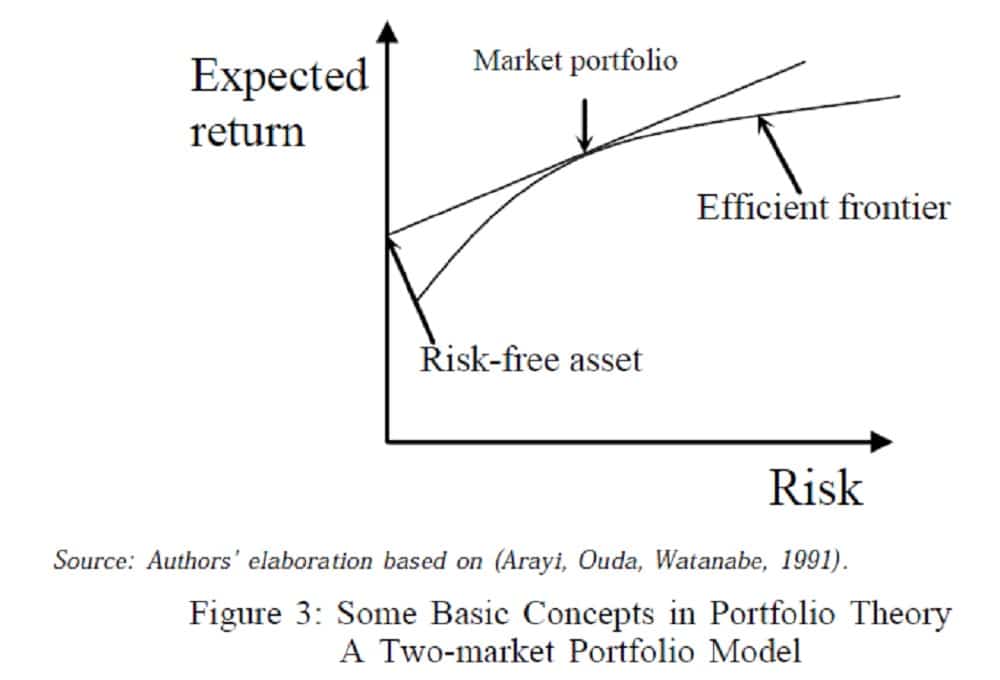

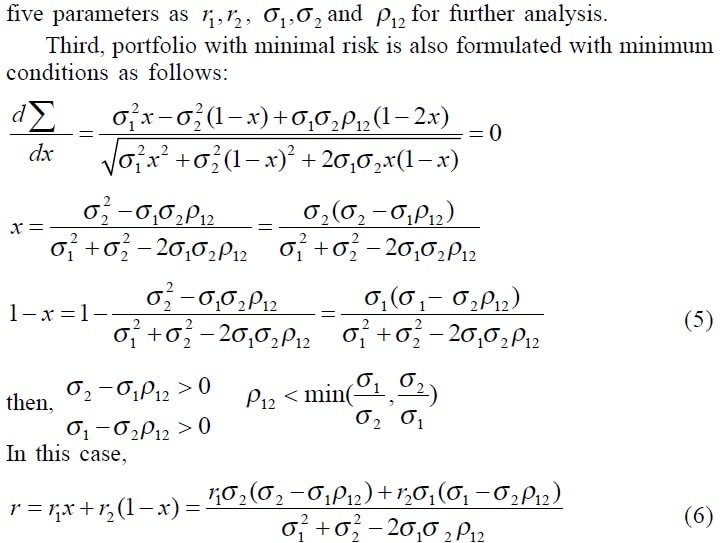

There are some elementary concepts in MPT including risk, return, efficient frontier, risk-free asset and market portfolio. As mentioned above, the risk’s proxy is the variance of return; and the return of a portfolio is the weighted combination of the asset’s returns in financial field. In terms of efficient frontier, “every possible asset combination can be plotted in risk-return space, and the collection of all such possible portfolios defines a region in this space. The line along the upper edge of this region is known as the efficient frontier. The efficient frontier is mathematically the intersection of the set of portfolios with minimum variance and the set of portfolios with maximum return” (Arayi, Ouda, Watanabe, 1991). The risk-free asset, just like its name shows, is the asset which has zero variance. Market portfolio, with the smallest variance as zero (here means risk free), is the portfolio that satisfies the conditions as risk minimum and and the largest return than the the efficient frontier. The simple image with such concepts can be illustrated in Figure 3.

For India’s software outsourcing service vendors, the biggest two important export destinations are the US and Europe. Based on this fact, the following two-market portfolio model is constructed.

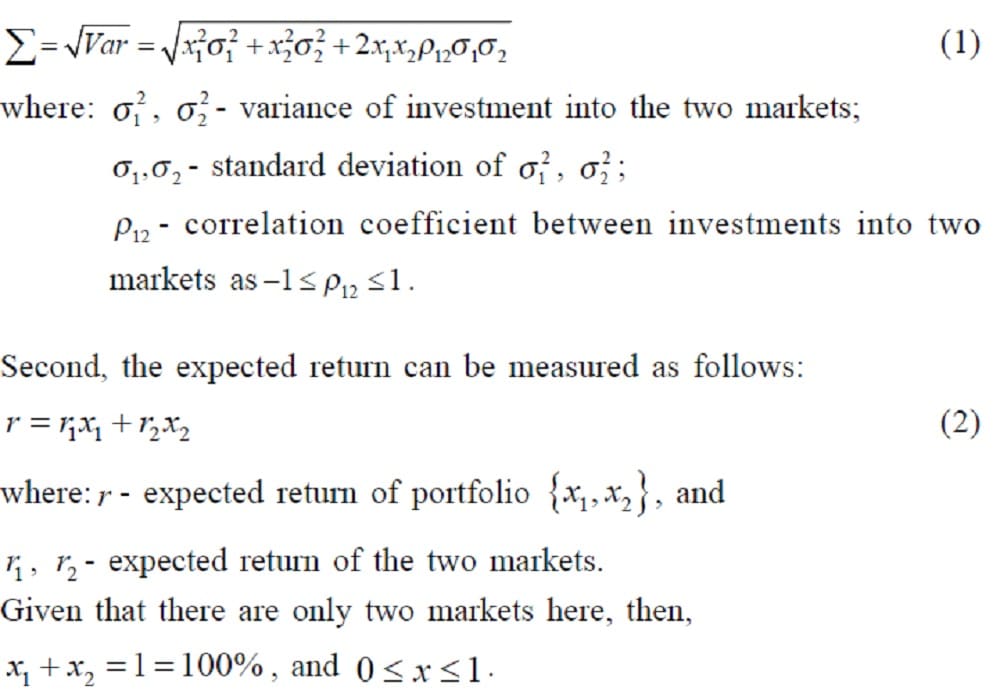

In case of two markets {x1, x2} first, as the risk’s proxy is the variance of return, risk can be measured as standard deviation of portfolio as follows:

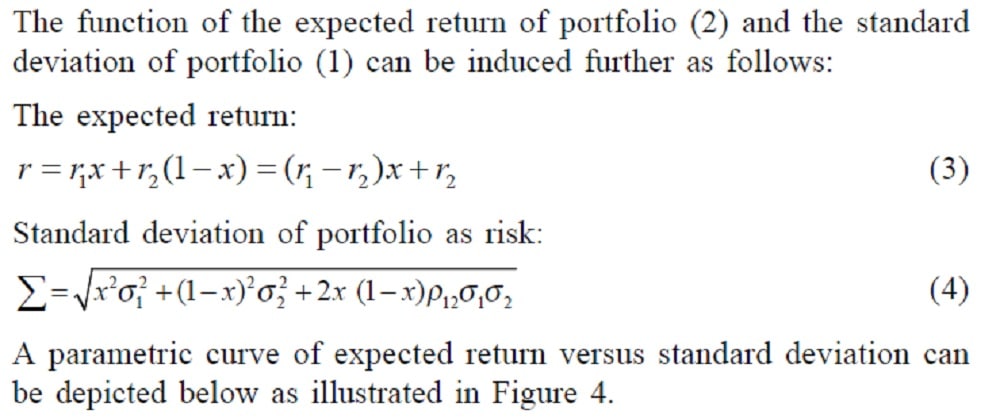

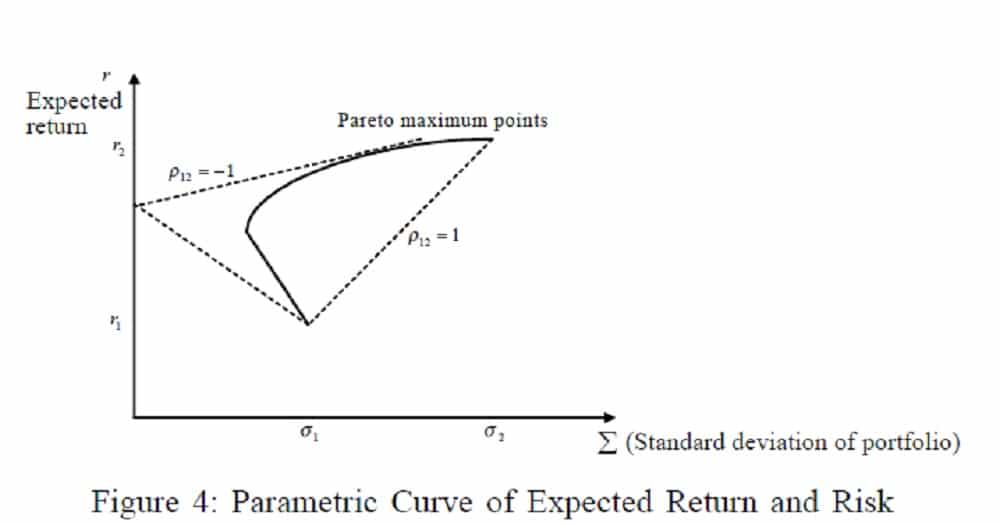

From Figure 4, we can conclude that it is important to figure out the

{X1, X2 } are referred to the US and the European markets for India’s outsourcing service vendors. The analysis is to find out the optimal portfolio between the two markets. Breakdown of India’s software export to the US and the European markets from 1997 to 2007 were used. In terms of the expected return, mean values of real data as export revenues were computed here and the results were standardized in order to guarantee the computation of the data in line with the risk. Based on the functions (5) and (6), utilizing the random numbers between 0 and 1, market ratio x can be computed.

ANALYTICAL RESULTS

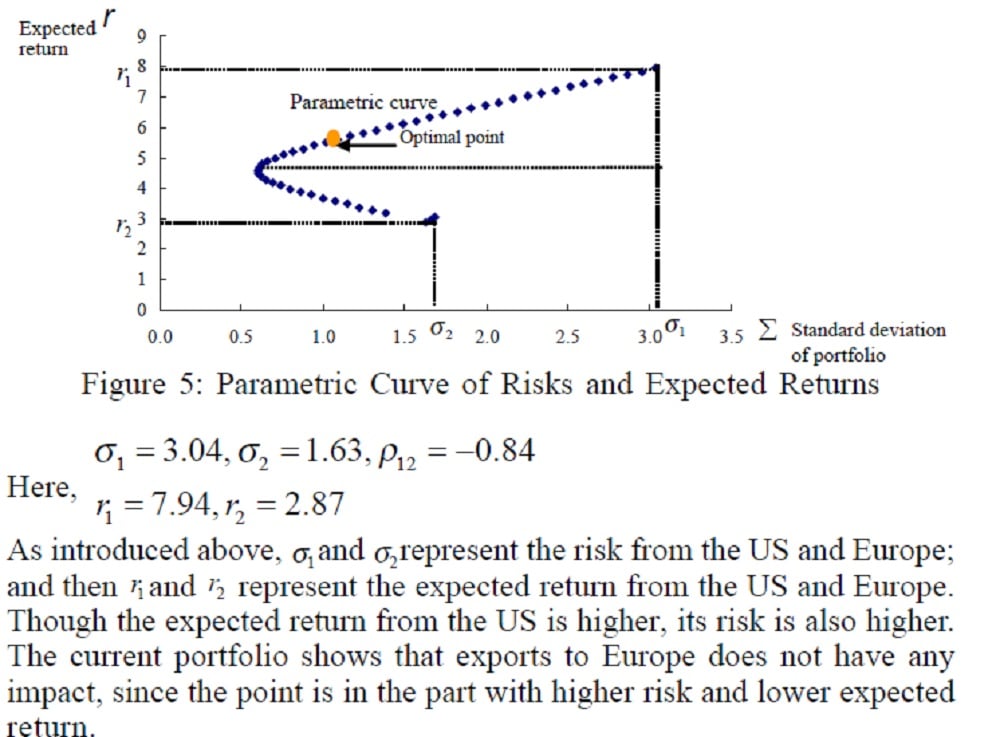

The five important parameters are figured out, and then by utilizing the computed parameters and the random numbers between 0 and 1 to produce correspondent risks and expected returns, the parametric curve can be depicted as illustrated in Figure 5.

With the calculation based on minimum risk as function (5) and maximum expected return as function (6), the optimal portfolio of x as 0.52 with risk as 1.017 and return as 5.506 is also clear now. It can be concluded that 52% is the optimal export ratio to the US for India in case of the two markets viz. US and Europe. Given that there are other destination markets for India except the US and the Europe, the ratio to the US should be much smaller than 52%. From Table 1, we know that risks from over dependence on the US market for India are obvious.

The region with the higher risks but lower returns (the part below the middle dot line in Figure 5) can be neglected. Other important points can be confirmed in the parametric curve. In the curve, the highest point is the one with the highest risk as 3.040 and the most beneficial return as 7.940; while the smallest point is the one with the risk as 0.599 and the lowest return as 4.594. The region with the points between the above two ones can be referred to when taking consideration. Then, for decision makers, they can make different decisions based on different principles related to risk exposure or risk avoidance.

DISCUSSION

It is known that to put all the eggs in one basket is very dangerous. It is the same as the risk in a portfolio of diverse several ones is less than the risk in only single one in stock investments. Diversification can reduce the risk to some degree and then more benefits can be reaped by diversification. However, only diversification is not enough to avoid all risks. Different diversification decisions, in other words, different portfolios can lead to different results of risk and return. We believe that there should be one best portfolio with good balance in lower risk and more beneficial return.

The above analysis is a two-market object analysis with the simplest portfolio model. The purpose is to extract implications and suggestions that software outsourcing service vendors should not neglect. Risks and risk management will be a good contributor to the success of outsourcing. Since the relationship between risks and returns can also be illustrated, decision-makings can be done according to different portfolios based on different principles from the perspective of risk exposure and risk averse.

Risk issues have been studied in many fields, especially in capital market, finance, insurance and management. Recently, it has become a hot topic in IT fields relevant to project management, software development and outsourcing service. However, in many cases, outsourcers’ profit and risk loss are focused, while the part for vendors is always neglected. With India’s case, this paper attempted to provide some analyses of risk from the perspective of outsourcing service vendors and figure out the optimal ratio for software exports between the US and European markets that are the biggest two software export destinations for India.

The limitation of the research is the scope of the analysis, as the analytical objectives in this paper were restricted to only two markets as the US and the Europe. It may be better if the analysis can be applied to all export destinations to find out the optimal portfolio and provide more suggestions in export destination market strategy for India. However, on one hand, it is difficult to collect the exact data for all export destinations, because there are usually no detailed data for countries except the US and the Europe. On the other hand, as we consider that India’s advantage in software outsourcing service is mainly on the US and European markets, the research focus on the two markets could provide more practical suggestions.

Risk awareness, avoidance and management in outsourcing are very crucial for the sustainable and healthy growth of software industry. Utilizing the simplest portfolio analysis model, the optimal portfolio between the two markets was figured out for India. It is concluded that the best export ratio to the US is about 52%. However, we can see from Table 1 that export ratios to the US were all over 60% with increasing trend to 70%. Though the result is not absolutely in line with real practice in some cases, it is a fact that India’s software industry has been more dependent on the US market for years, which incorporates unavoidable risks from many aspects as mentioned in the section of background. India should reconsider its market strategy in exports and this kind of relationship with the US. It does not mean that India can neglect the US market or decline the customers from the US, on the contrary, it is very important to go on keeping the good partnership with the US because of its main customer’s position for India. In the meantime, to strengthen its domestic market, tap new foreign markets and positively improve the market shares are also very crucial. The undeveloped domestic market has been the development bottleneck for the Indian software industry and made the risk in software exports much dangerous. India can enlarge the domestic market demand by appropriate policy incentives and indispensable institutional changes. For foreign markets, India should pay more attention to the potential market resources in the Europe and take activities in other countries to make new market share by its well-known outsourcing service quality and talents. All these efforts are believed to reduce the risks and guarantee the sustainable development of the Indian software industry.

REFERENCES

Aubert B.A., Rivard S. and Patry M. (2001) Managing IT Outsourcing Risk: Lessons Learned, CARANO.

Arayi T., Ouda T. and Watanabe S. (1999) Capital Market and Corporate Finance, Tokyo, Chuou Economic.

Charles, B.K. Reducing Outsourcing Risk through Visual Communication, Available from

<URL:http://www.cognetics.com/papers/charlie/outsourcing_risk.pdf>.

Davison D. (2004) ‘Top 10 Risks of Offshore Outsourcing’, CIO News, Meta Group. Available from <URL: http://searchcio.techtarget.com/news/article/0,289142,sid182_gci950602,00.html>.

Earl M.J. (1996) ‘The Risks of Outsourcing IT’, Sloan Management Review, Spring: 26-32.

Gack G.A (1994) ‘Cautionary Tale’, Computer world, September 12: 136-136.

Gupta U. and Gupta A. (1992) ‘Outsourcing the IS Function: Is It Necessary for your Organization?’, Information Systems Management, Summer: 44-50.

Hirschheim R. and Lacity M. (2000) ‘The Myths and Realities of Information Technology Insourcing’, Communication of the ACM, 43: 2, 99-107.

Huff S.L. (1991) ‘Outsourcing of Information Services’, Business Quarterly, Spring: 99-107.

Kearney A.T. (2004) Offshore Location Attractiveness Index: Making Offshore Decisions,

ATKEARNEY. Available from <URL: http://www.atkearney.com/shared_res/pdf/Making_Offshore_S.pdf>.

Markowitz H. (1952) ‘Portfolio Selection’, The Journal of Finance, VII: 1, 77-91.

National Association of Software and Service Company (2007) Executive Summary, India.

National Association of Software and Service Company (2007) Indian IT Industry Factsheet, India.

National Association of Software and Service Company (2007) Key highlights of the

NASSCOM-IDC study on the domestic services market opportunity, India.

Oza N.V., Hall T., Rainer A. and Grey S. (2006) ‘Trust in software outsourcing relationships: An

empirical investigation of Indian software companies’, Information and Software Technology, 48: 345-354.

Reining in Outsourcing Risk (2005). Available from <URL:http://www.strategy-business.com/

press/sbkw2/sbkwarticle/sbkw051130?pg=all>.

Sakakibara E. (2001) Indian IT Revolution’s Marvel. Tokyo, Bungeishunju Ltd.

<URL:http://unpan1.un.org/intradoc/groups/public/documents/NISPAcee/UNPAN015537.pdf>.

<URL: http://www.gfe.de/Publication/Indian%20Software%20Industry.doc>.

<URL: http://www.businessweek.com/adsections/indian/infotech/indiaexport.htm>.

<URL: http://www.noida.stpi.in/it_industry.doc>.

<URL: http://www.thehindubusinessline.com/2002/07/19/stories/2002071900780700.htm>.

Weilin Zhao is in department of Industrial Engineering and Management, Tokyo Institute of Technology, Japan.

Chihiro Watanabe is in department of Industrial Management, Tokyo Institute of Technology and Visiting Professor in National University of Singapore also Senior Advisor to the Director on Technology in International Institute for Applied System Analysis.